- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

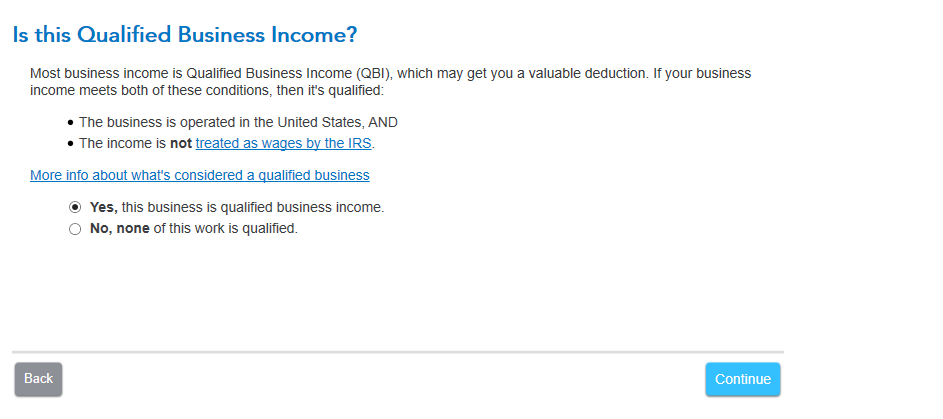

If you are claiming the Qualified Business Deduction, this will be asked after you answer all the income and expense questions in the business section. All you need to do is select Yes, this business is qualified business income.

Generally, consulting is excluded from the QBI as it is listed as one of the SSTB's unless you meet an exclusion which includes your taxable income being less than $383,9000 if married filing jointly, or $191,950 if you use any other filing status.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 31, 2025

8:06 AM