- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

If you have selected you are married and completing the tax return with your spouse in the My Info section of the program then you are filing as Married Filing Jointly.

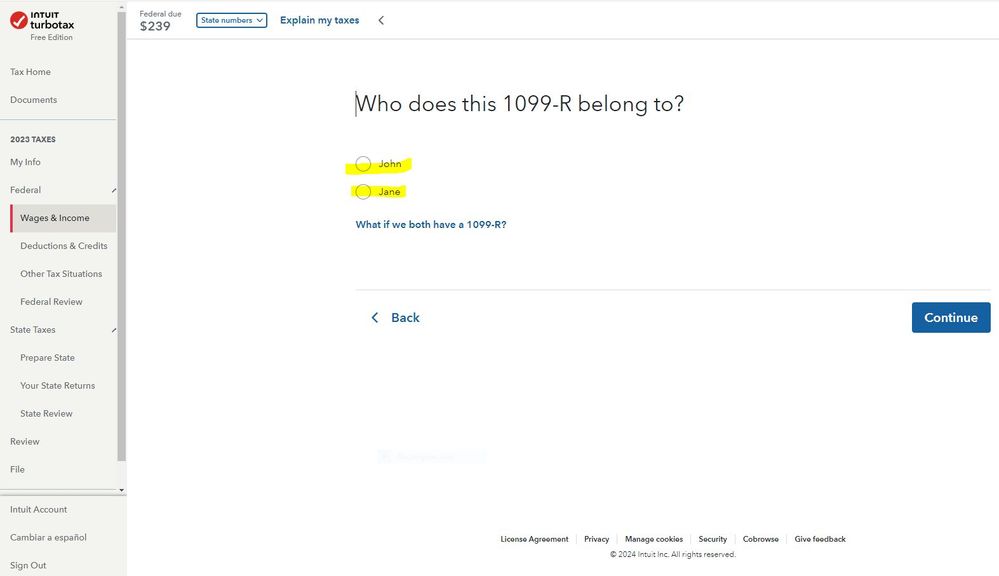

When entering your Form 1099-R you have to check the box for you or your spouse, by Name

Go back to the Form 1099-R section and then select the name of who is reporting this Form 1099-R.

To enter, edit or delete a form 1099-R -

Click on Federal Taxes (Personal using Home and Business)

Click on Wages and Income (Personal Income using Home and Business)

Click on I'll choose what I work on (if shown)

Scroll down to Retirement Plans and Social Security

On IRA, 401(k), Pension Plan Withdrawals (1099-R), click the start or update button

Or enter 1099-r in the Search box located in the upper right of the program screen. Click on Jump to 1099-R

On the screen Did you get a 1099-R in 2023? Click on Yes

On the next screen click on Continue

On the screen Let's import your tax info Click on Change how I enter my form

On the screen How do you want to add your 1099‑R? Click on Type it in myself

On the screen Who gave you a 1099-R? select the type of 1099-R you received and Continue