- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Georgia Form 700 Schedule K-1 - What's the difference between Total Income for Georgia Purposes vs Total Georgia Income?

Hello Turbotax Community,

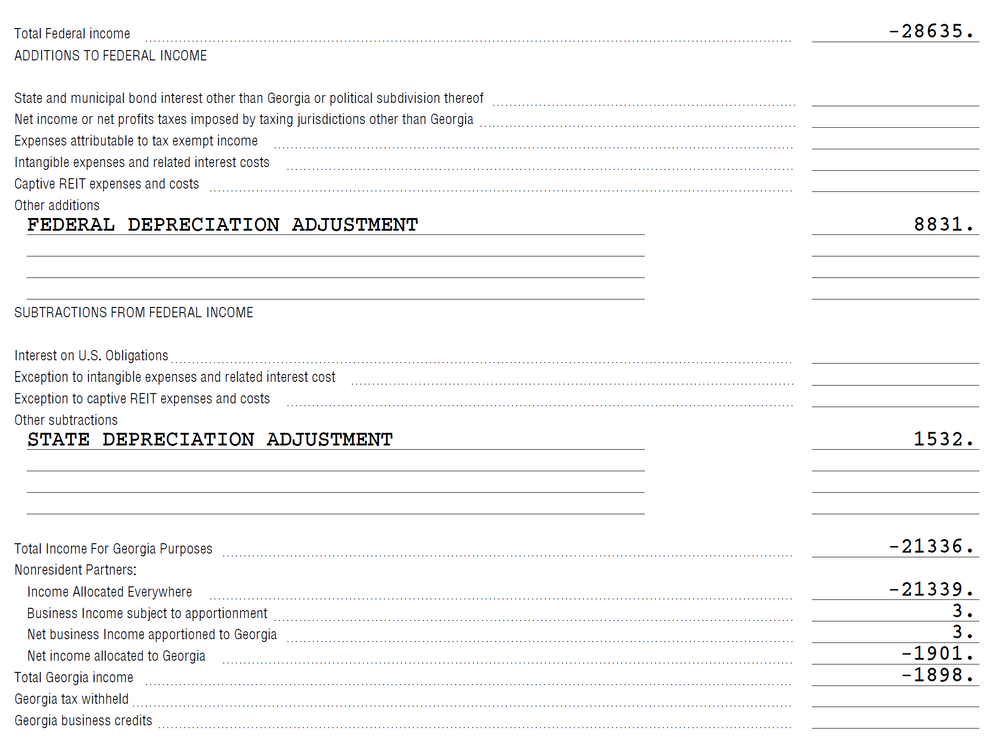

I am a resident of NJ. I invested in a real estate syndication fund back in Dec 2021 which owns several apartments in GA, TX, and FL. I did not receive any distributions during 2021 (although my investment earned $26 interest though). I got my 1065 K1 yesterday with a GA 700 form attached to it. See the GA 700 screenshot below.

As expected, it was a net loss due to the bonus depreciation (-$28,635). I understand that GA does not fully recognize the bonus depreciation. Hence, depreciation adjustment was applied. I understand how it went from -$28,635 down to -$21,336. I need some help to understand what's the difference between the Total Income for Georgia Purposes (-$21,336) vs the Total Georgia Income (-$1,898).

- Does this mean GA only recognizes the (-$1,898) in depreciation since the entire (-$28,635) in depreciation may belong to other properties in TX/FL?

- From a TT reporting standpoint, I assume the number that I need to report in GA is the Total Georgia Income (-$1,898), NOT the Total Income for Georgia Purposes (-$21,336)

Appreciate your guidance! Thanks!