- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Second Home 1099-S 2020 Turbo tax Premier

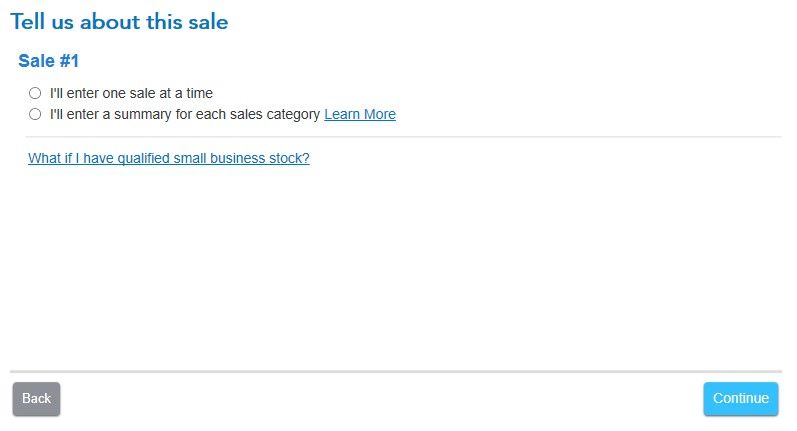

I have done everything the discussion board says to do for entering the sale of a second home .... there is no type of sale for a second home.... only asking for 1099-B. how do I enter my 1099-S?

This is all I get - I have a 1099-S and need to include it. How do I do that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

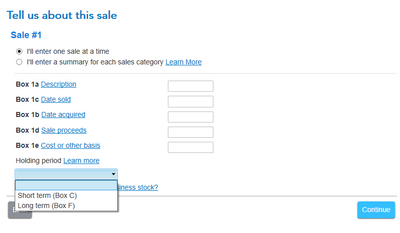

Select that you will enter one sale at a time and enter the transaction on the following screen (as if it were the sale of a stock or bond).

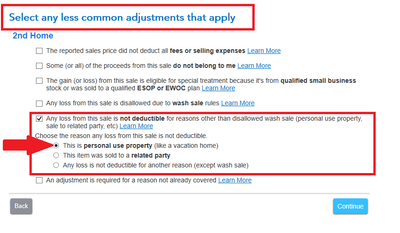

If you have a loss, make sure you check the appropriate box on a following screen since losses from the sales of personal use property are not deductible.

If you have ever used the second home as a rental, you will have to use a different method to enter the sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

It has different data boxes... and does not correlate with the sale of a second home.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

@Dboersma wrote:

It has different data boxes... and does not correlate with the sale of a second home.

It has all of the data boxes you need to report the sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

The sale of a second home is entered just like stock sales on the same screen and will be reported on the Sch D & 8949 ... there is no direct 1099-S entry screen because the IRS doesn't require it ... the sale on the 1099 just needs to be reported on the Sch D so don't get hung up on the box labels.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

@tagteam I’m also stuck on this section. I sold my second home at a loss ...i filled everything out but it’s still saying I can use $3000 capital loss for 2020 and $110k to carry forward for 2021 but you had mentioned to make sure I click on the correct box since losses can’t be deducted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content