- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

I made another space in my home available for clients and their families while they're waiting to be seen in my home office. this space happens to also be my living room so it's not 100% used for work. Because it is not used 100% for work, it does not meet the exclusive use test, therefore you cannot take any type of home office deduction for this area. So the waiting area does NOT get entered on your return.

As for the $4,000 that you spent, you could add that as an expense for the home office since it was directly done to the home office. However, anything part of that that you spent for the part that does not qualify for the home office would not be deductible. You will enter the portion that applies to the home office as an improvement. After you enter all of your home office expenses, you will come to a screen that says summary of home office expenses. Click continue.

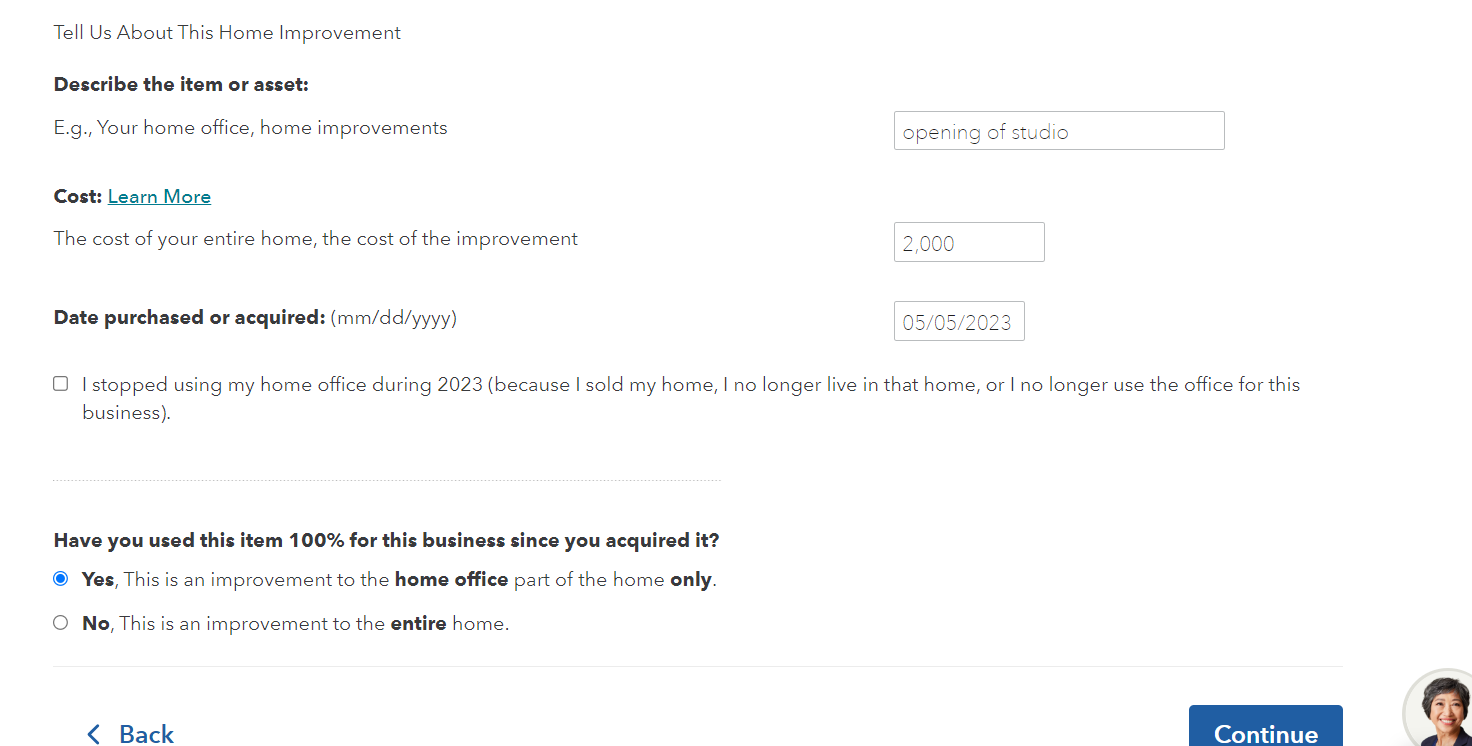

You will then come to a screen that says Depreciating your home. Here you can select an "Improvement to your home". Hit continue, then enter the information about your improvements. In the cost, you will enter ONLY the portion that is related to your home office, not the part that is in the Living Room. Then select Yes, this is an improvement to the home office part of the home only. Hit continue. Continue through the questions and it will give you a depreciated amount for the deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"