- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter CA real estate withholding?

I live and file in CA. I sold a rental house and 3% was withheld for Franchise Tax Board Real Estate Withholding by the escrow company. I have not received a Form 592-B or Form 593. Where and how do I enter the amount withheld?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

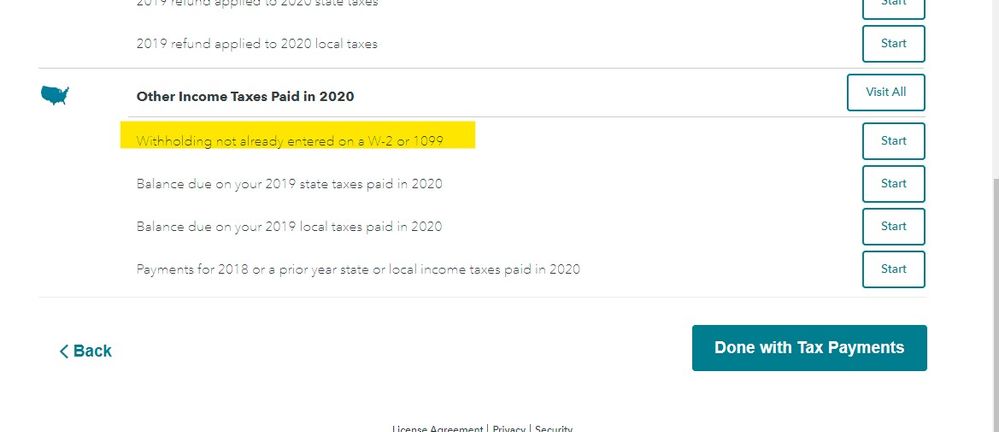

Enter the amount withheld in the "Withholding not already entered on a W-2 or 1099" interview.

This interview is found under Federal Taxes > Deductions and Credits > Other Income Taxes > Other Income Taxes paid in 2016.

See the attached screenshot to see what the entry screen will look like.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

I think this is out dated. THis is required by the state and needs to placed somewhere

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

The info is not outdated ... the state withholding is entered in the federal section and will be carried to the state automatically.

Look in the Deductions & Credits section ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

We solved the problem with some advise from TurboTax, we did use efile and the returns are complete and accepted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

I am getting the same message from TurboTax that because when I sold the property the escrow company just withheld 3.33% of the sale. Can I efile if I did not get a form 523 or whatever it is that lists real estate witholdings?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Yes, you can e-file and you can enter the amount of tax withheld as long as you know the dollar amount.

Here is how to enter it:

- Select Federal, then Deductions and Credits.

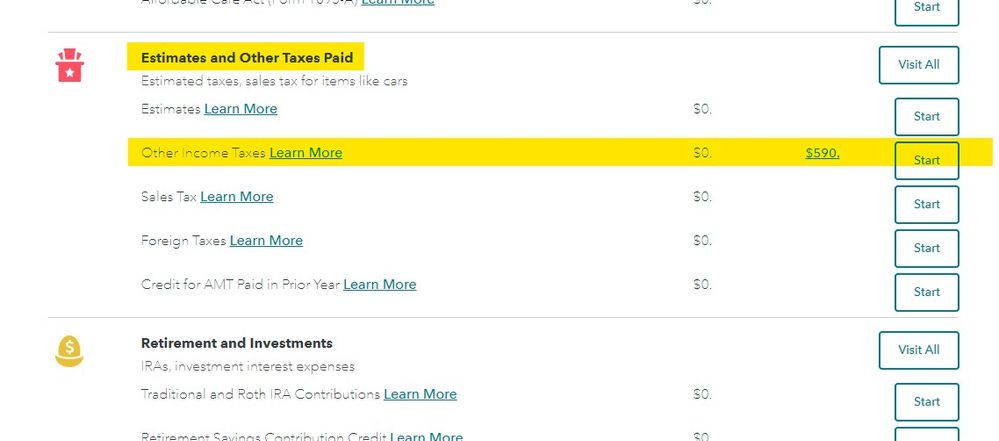

- Scroll down/ expand the list and find Estimates and Other Taxes Paid.

- Select Other Income Taxes.

- Scroll and select Withholding not already entered on W-2 or 1099.

- Answer the question Yes and Continue.

- Enter your federal tax withheld and/ or select a state and enter state tax withheld.

Make sure you know what type of tax was withheld, this is for income taxes only.

**Mark the post that answers your question by clicking on "Mark as Best Answer"