- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

No. As long as you make the purchase on or before December 31, you can take the section 179 deduction. On the screen asking about the special depreciation, it also says the Section 179...it is just using two different terms for the same thing.

If you went through one time, you will frequently not have the exact same question, so if you cannot get back to the original questions, you can delete that vehicle and re-enter it, making sure that you select yes the first time.

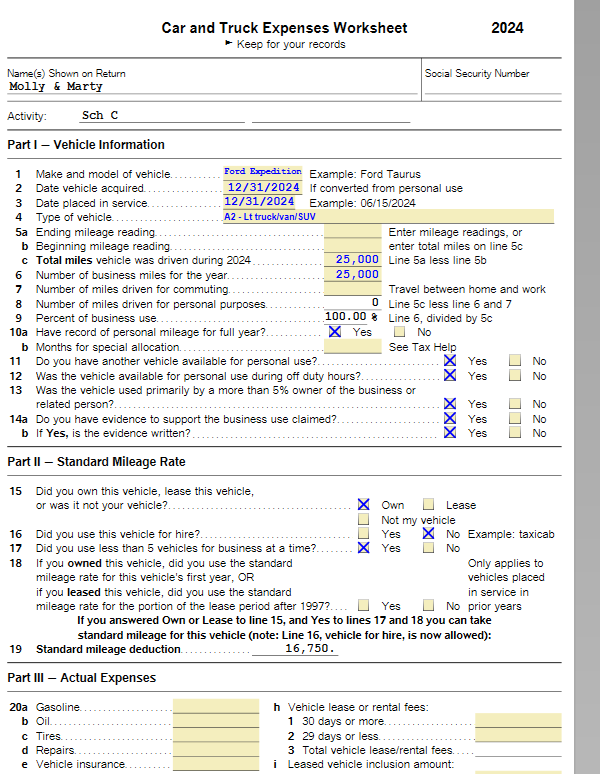

If you are using the desktop version (which means you downloaded it and installed it on your computer, that you are not logging in to your return) you can switch to forms mode and enter directly on the form itself for the care and truck expenses worksheet. Your screenshot, does appear to be the online version and not the desktop version. If so, your questions will be slightly different than the desktop versions but the special allowance is the same thing as the section 179 for this purpose.

**Mark the post that answers your question by clicking on "Mark as Best Answer"