- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

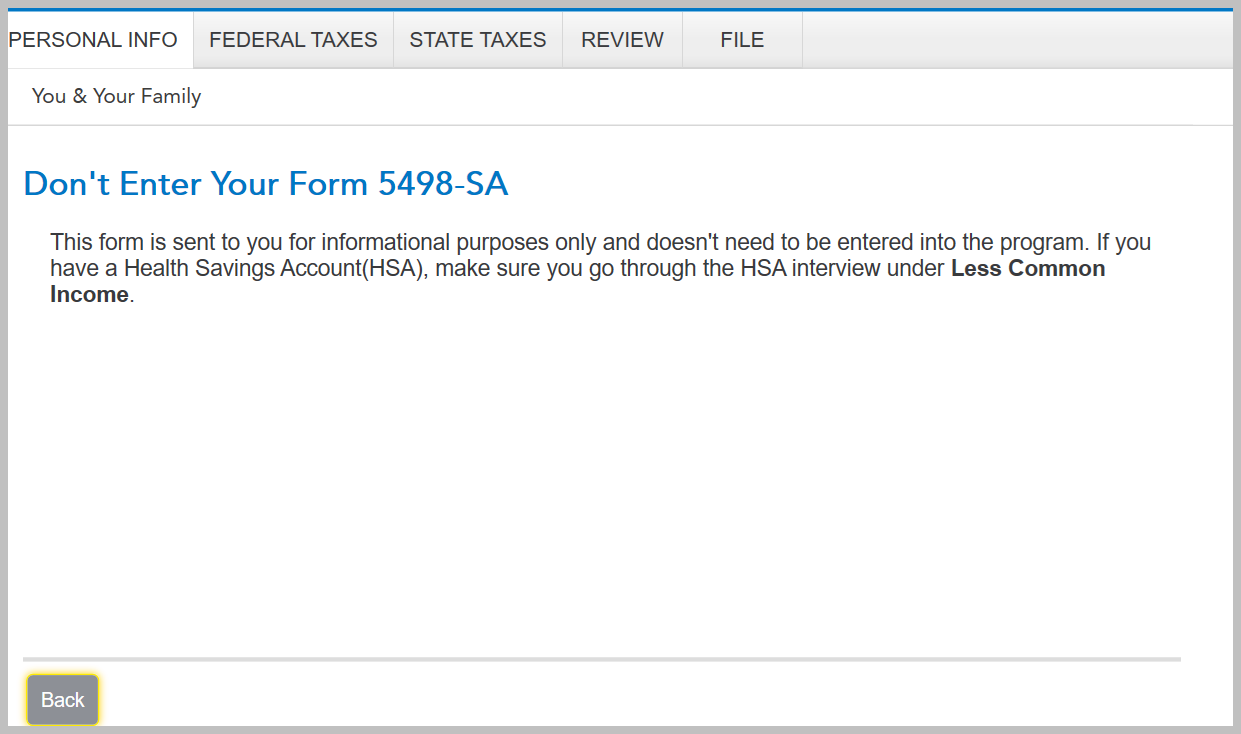

You are correct, you do not have to enter Form 5498-SA into TurboTax. The Form 5498-SA section of the TurboTax program simply says that you don't have to enter the form and that the form is for informational purposes only, as a reminder.

The information on Form 5498-SA reports your HSA contributions and any contributions to MSA or Medicare Advantage Medical Savings Accounts.

To get to the TurboTax questions that are relative to HSA, MSA and Medicare Advantage Savings Accounts, if you are using TurboTax Online or Mobile, you can click on this link to take you directly to those questions: Tell us about the health-related accounts you had in 2024 screen.

Or you can do the following in TurboTax Online or TurboTax Desktop:

- Click on the search icon in the upper right side of your TurboTax screen.

- Type "hsa" in the search box

- Click on the link "Jump to hsa"

For Form 5498-SA you can do the following (but it is simply a reminder that you do not have to enter your form.

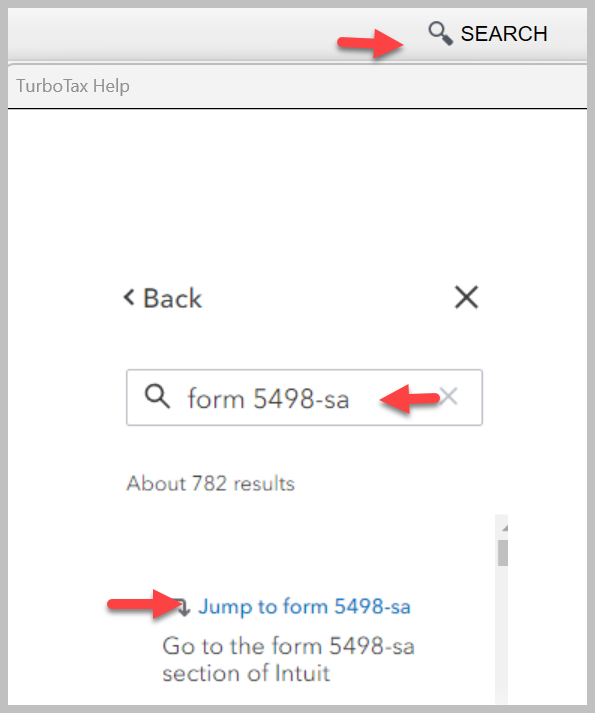

- Click on the search icon at the top right of your TurboTax screen.

- Type "form 5498-sa" (just like that) in the search bar

- Click on the link "Jump to form 5498-sa"

Your screens will look something like this:

Click here for "Do I need to enter Form 5498-SA?"

Click here for "About Form 5498-SA, HSA, Archer MSA, or Medicare Advantage MSA Information"

Click here for "Form 5498-SA"

**Mark the post that answers your question by clicking on "Mark as Best Answer"