- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

I edited my answer above. A forfeited amount is not taxed, only funds that were not used for Dependent Care are.

First, make sure your employer doesn't have a grace period you can use for the funds. Not all plans have this, so you will have to check.

For employees, the main downside to an FSA is the use-it-or-lose-it rule. If the employee fails to incur enough qualified expenses to drain his or her FSA each year, any leftover balance generally reverts back to the employer. However, there are two exceptions to the use-it-or-lose-it rule.

An FSA plan can allow a grace period of up to 2 1/2 months. For a calendar-year FSA plan, that gives employees up to March 15 of the following year to incur enough expenses to soak up their unused FSA balances from the previous year (most FSA plans are operated on a calendar-year basis).

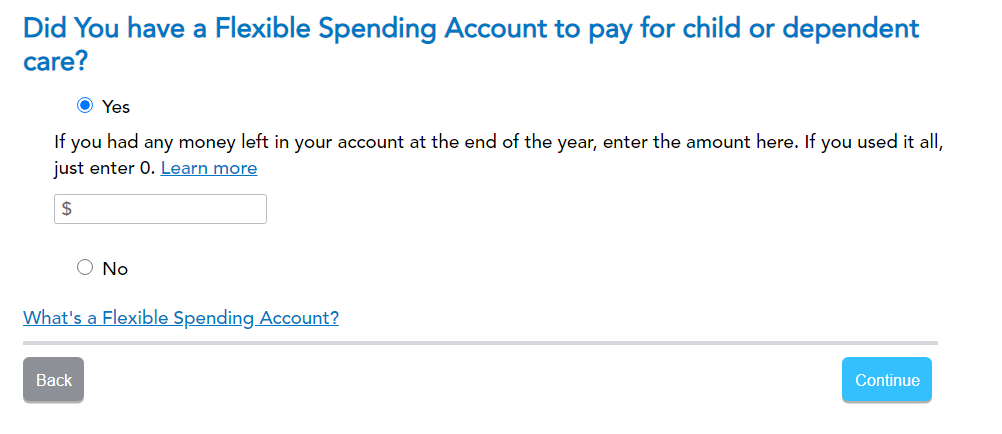

If you don't have the grace period, you will see this screen after you enter your W2-

You will want to say what amount you forfeited here. If you enter the forfeited amount here, you will not be taxed on it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"