- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

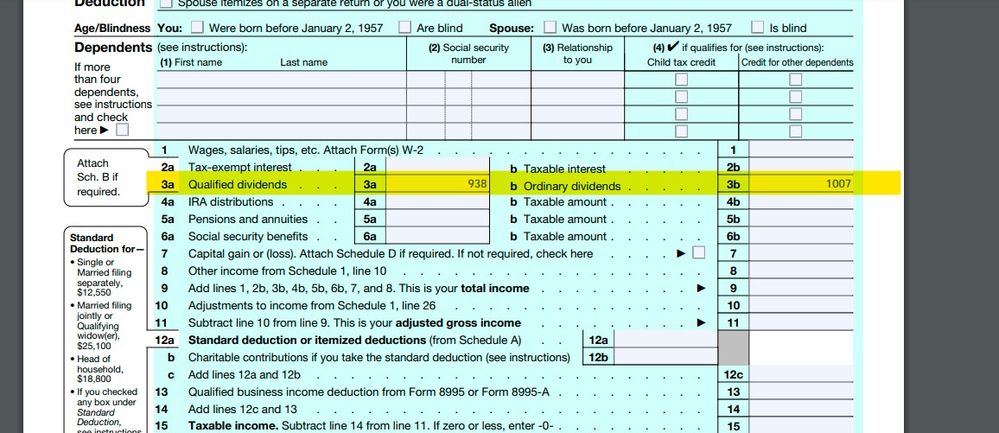

Ok ... you need to understand the way these are handled on the tax return ... he earned 1007 of total dividends OF WHICH 938 "qualify" for long term cap gains tax treatment ... the way it is reported on the 1099-DIV is correct and you MUST enter it just that way in the program or you will get an IRS letter later.

Now ... the program will enter the total dividends on the form 1040 line 3b and the qualifying div on line 3a. The total on line 3b will be included in the total AGI and that is correct. When it comes to calculating the tax liability it will be done on the Qualifying Dividends and Capital Gains Tax Worksheet so be patient and review that form to see how that works in the end.

August 20, 2022

4:56 AM