- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

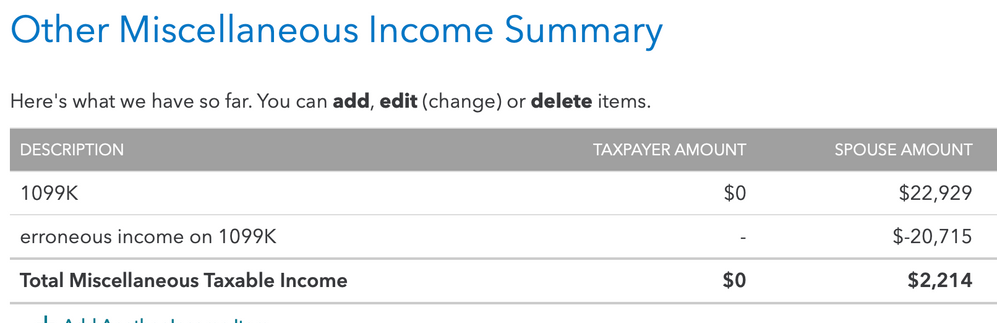

My wife got a 1099K from PayPal and it shows 22k. Sometimes she sold off unused items like an online garage sale. However most of it was her buying an expensive purse, then turning around and selling it. Often she would sell the purse for what she paid for it. Sometimes she made a very small profit. Most of the time she was "trading" a purse for another purse. But since you can't trade online, she would sell hers to a person that she was in turn buying one from. Usually it was the same amount. For example, she sold to an online Facebook friend her purse for 500 and bought theirs for 500. This way both of them were protected as buyers/sellers on PayPal. But there was zero income on cases like that but the 1099K makes it look like a 500 income.

She sat down and wrote down all of the items she bought and then sold and has proof of purchase for. She went back and looked at all of her shipping costs that she has proof of. Basically it was just her buying used stuff like purses, not really using them if maybe a few times, then selling them and buying more purses. So really it was just recycling the same money. We searched online and talked to others and got mixed responses. When we list it as a hobby and add the expenses, it does not change the tax owed as it seems to disregard the "expenses".

I did find a suggestion based on this thread that seems to really fit best, does anyone see any issues or a better way this needs to be filed? This guy reported getting money as a loan.

1099-K from PayPal and I don't have a business

The suggest was to do the following

In TurboTax (TT), enter at:

- Federal Taxes tab (Personal in Home & Business)

- Wages & Income

Scroll down to:

-Less Common Income

-Misc Income, 1099-A, 1099-C

- On the next screen, choose – Other reportable income

- On the next screen, click yes

- On the next screen, you'll get blanks to enter the amount and a description. It will go on line 8 of Schedule 1 as "Other Income". Suggestion for description: erroneous income on 1099K

When that's done, do it again (a 2nd entry). This time make it a negative entry; put a minus sign (-) in front of the amount. Suggestion for description: erroneous income on 1099K offset

Here is what that outcome looks like when I follow that guide/suggestion. It looks fair since she really had about 2200 as an actual income that she made. If she bought a purse for 500 and sold it for 550 she only had a 50 dollar income but the 1099k would make it look like it was an outright 500 which is what we are struggling with. She wasn't selling for profit at all, she was just selling to turn around and buy a different one.

I tried to do it first using the generic income as a business but TurboTax wanted me to pay over 100 as a small business, which we are not.

If I tried to do it as a hobby and then list expenses of 20,715, It would disregard the expenses. I tried it with the expenses and then without expenses and the tax OWED stayed the same. I'm guessing it was looking at expenses like it would art supplies for a online painter, as example and not really seeing that as negative.

Thanks for the help