- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Wife has 1099K from PAYPAL. - not a business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

My wife got a 1099K from PayPal and it shows 22k. Sometimes she sold off unused items like an online garage sale. However most of it was her buying an expensive purse, then turning around and selling it. Often she would sell the purse for what she paid for it. Sometimes she made a very small profit. Most of the time she was "trading" a purse for another purse. But since you can't trade online, she would sell hers to a person that she was in turn buying one from. Usually it was the same amount. For example, she sold to an online Facebook friend her purse for 500 and bought theirs for 500. This way both of them were protected as buyers/sellers on PayPal. But there was zero income on cases like that but the 1099K makes it look like a 500 income.

She sat down and wrote down all of the items she bought and then sold and has proof of purchase for. She went back and looked at all of her shipping costs that she has proof of. Basically it was just her buying used stuff like purses, not really using them if maybe a few times, then selling them and buying more purses. So really it was just recycling the same money. We searched online and talked to others and got mixed responses. When we list it as a hobby and add the expenses, it does not change the tax owed as it seems to disregard the "expenses".

I did find a suggestion based on this thread that seems to really fit best, does anyone see any issues or a better way this needs to be filed? This guy reported getting money as a loan.

1099-K from PayPal and I don't have a business

The suggest was to do the following

In TurboTax (TT), enter at:

- Federal Taxes tab (Personal in Home & Business)

- Wages & Income

Scroll down to:

-Less Common Income

-Misc Income, 1099-A, 1099-C

- On the next screen, choose – Other reportable income

- On the next screen, click yes

- On the next screen, you'll get blanks to enter the amount and a description. It will go on line 8 of Schedule 1 as "Other Income". Suggestion for description: erroneous income on 1099K

When that's done, do it again (a 2nd entry). This time make it a negative entry; put a minus sign (-) in front of the amount. Suggestion for description: erroneous income on 1099K offset

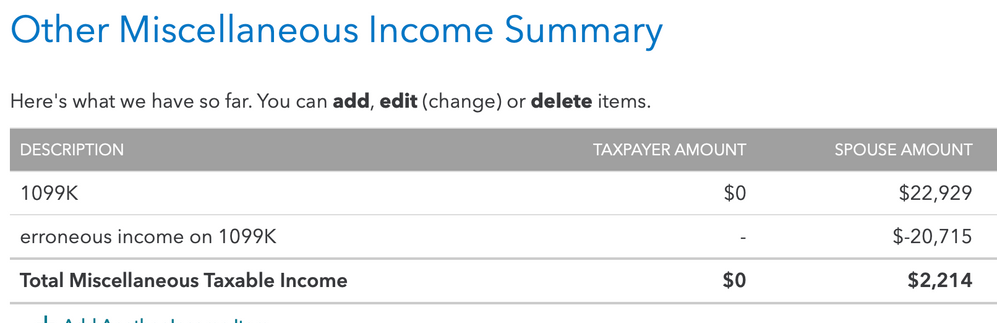

Here is what that outcome looks like when I follow that guide/suggestion. It looks fair since she really had about 2200 as an actual income that she made. If she bought a purse for 500 and sold it for 550 she only had a 50 dollar income but the 1099k would make it look like it was an outright 500 which is what we are struggling with. She wasn't selling for profit at all, she was just selling to turn around and buy a different one.

I tried to do it first using the generic income as a business but TurboTax wanted me to pay over 100 as a small business, which we are not.

If I tried to do it as a hobby and then list expenses of 20,715, It would disregard the expenses. I tried it with the expenses and then without expenses and the tax OWED stayed the same. I'm guessing it was looking at expenses like it would art supplies for a online painter, as example and not really seeing that as negative.

Thanks for the help

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

No, a Schedule C Profit or Loss from Business is used when there is an intent to make a profit and the net profit over $400 is subject to self-employment tax. You are not allowed to deducted expenses for a hobby business however, you may deduct the Cost of Goods Sold (COGS).

To report your wife's 1099-K from eBay and her cost of goods sold (COGS) in TurboTax follow these steps:

- Log in to your TurboTax account if it is not open.

- Select the Wages & Income tab.

- Scroll down to Less common income click Show more.

- On the page Let's Work on Any Miscellaneous Income click on Other reportable income.

- On the page Any Other Taxable Income? select yes.

- On the page, Other Taxable Income enter eBay 1099-K for the description and the amount.

- Select continue and answer No on the next page.

Next, you will have to report your COGS. Follow these steps to report your COGS:

- Log in to your TurboTax account if it is not open.

- Select the Wages & Income tab.

- Scroll down to Less common income click Show more.

- On the page Let's Work on Any Miscellaneous Income click on Other reportable income.

- On the page Any Other Taxable Income? select yes.

- On the page, Other Taxable Income enter eBay 1099-K COGS for the description and the cost of the items sold as a - amount for example -1,200.

- Select continue and answer No on the next page.

This process will report your gross income reported to you on the 1099-K in the first entry and then "back-out" your COGS in the second entry. As you are aware this is the first year of the new filing requirements for Form 1099-K and there is no one single step to report the sale and COGS if you are not a business.

@armybrat13

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

So you are correct, with everything you have described, it does sound as though your wife's activity is a hobby. However, with that said, she cannot deduct expenses. She can only deduct the cost of goods like @Leonard Smith stated. The purse or other items she is buying is her cost of goods. She cannot deduct her selling expenses such as the shipping costs.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

It is not an erroneous 1099-K so you will have to enter it in as a business activity, and record the cost of goods sold there if you want to avoid the high taxes. The other method is an incorrect way of doing it and will just raise the eye of the IRS. It is actually a pretty lucrative business not a hobby, making a few dollars to renew a lavish item throughout the year. You do not want to mess with that by trying to work around the tax program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

Thank you. Definitely not trying to get around anything. Just trying to pay taxes on the actual profit of 2k. In the following website the seller talks about the confusion that online market place sellers getting a 1099-k think they have to pay taxes on all of it when they only owe takes on the profit. They give the example of getting a 1099K for 25K but having purchased 20k worth of goods at the same time. They report the 5k difference is the profit that one would then have as the taxable income. I'm at a loss at how to file this because each different online suggestion seems to have a vastly different outcome. On this article, he suggests filing a Schedule C? Is that inline with what you are recommending?

https://www.eseller365.com/ebay-etsy-marketplace-sellers-irs-1099-k-guide/

Usually, as a sole proprietor and you will have to file a Schedule C (Form 1040) with your tax return. Schedule C has spaces for you to enter applicable business expenses (Part II Expenses) to reduce your income. In rare cases, you may even have a loss, which could help you lower your overall tax burden. But then why are you in business?

We didn't have a net loss, but I can imagine a lot of people that have this as a "hobby" absolutely could have a net loss. He asks then "why are you in business", which is the point that people in our situation are trying to make, we simply are not in business. My wife is not trying to make an income/profit. She simply found a way to have the joy of shopping and finding bags/purses that she likes. She keeps them for a short time and then sells them again. Most of the time she gets back what she put into it. Sometimes she looses money after fees and shipping. Occasionally she gets a profit. But she's not trying to make money, she is simply trying to keep the process going without having to burden the family budget. For her, it was a way to keep sane during Covid by selling stuff she bought online usually at cost to then buy something else. Essentially, you start with 500. You buy something and then turn around and sell it for 500. Then you turn around and buy something else for 500. Keep it for a second and then sell it for 500. At the end of the day, you are just flipping your 500 over and over. But to PAYPAL, they see a 1099K for several thousands of dollars in income. That's why I was thinking erroneous based on that suggestion of someone else online because she didn't actually earn 22k. If she invested 20k into a used car that she then sold for 22k, she only had a profit of 2k. That's about 166 a month, or about 41 dollars a week. We are just trying to figure out the best way to file the profit while acknowledging the expenses.

Would you suggest schedule C?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

No, a Schedule C Profit or Loss from Business is used when there is an intent to make a profit and the net profit over $400 is subject to self-employment tax. You are not allowed to deducted expenses for a hobby business however, you may deduct the Cost of Goods Sold (COGS).

To report your wife's 1099-K from eBay and her cost of goods sold (COGS) in TurboTax follow these steps:

- Log in to your TurboTax account if it is not open.

- Select the Wages & Income tab.

- Scroll down to Less common income click Show more.

- On the page Let's Work on Any Miscellaneous Income click on Other reportable income.

- On the page Any Other Taxable Income? select yes.

- On the page, Other Taxable Income enter eBay 1099-K for the description and the amount.

- Select continue and answer No on the next page.

Next, you will have to report your COGS. Follow these steps to report your COGS:

- Log in to your TurboTax account if it is not open.

- Select the Wages & Income tab.

- Scroll down to Less common income click Show more.

- On the page Let's Work on Any Miscellaneous Income click on Other reportable income.

- On the page Any Other Taxable Income? select yes.

- On the page, Other Taxable Income enter eBay 1099-K COGS for the description and the cost of the items sold as a - amount for example -1,200.

- Select continue and answer No on the next page.

This process will report your gross income reported to you on the 1099-K in the first entry and then "back-out" your COGS in the second entry. As you are aware this is the first year of the new filing requirements for Form 1099-K and there is no one single step to report the sale and COGS if you are not a business.

@armybrat13

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

Excellent, that makes the most sense for our situation.

In regards too COGS, would that also include her shipping fees? Seems like it would be part of the Cost of the Goods that were sold.

In regards to " the description and the cost of the items sold amount" - would that be gross cost of goods or itemized list of each and every item?

Regards,

Lokin Crook

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

No, shipping fees would be considered Shipping and Postage under office expenses if you are a business. You can select postage and office expenses by selecting the following:

- Federal

- Income and Expenses

- Edit next to your business

- Add Expenses

- Office Expenses

If this is just a hobby, then shipping expenses would not be deductible. Shipping expenses are not part of the cost of goods sold. Only your cost of goods such as the material used to make/purchase the product and packaging (like the wrapper on the product). If this were a business you could also deduct the cost of labor directly involved in making the product or selling the product. (without intent to earn a profit you would not likely have labor costs.)

Edited 3/21/2022 @12:43PM PST

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

@Vanessa A Your suggestion only seems to be appropriate for independent businesses not "Miscellaneous Income" >> "Other reportable income" as suggested by @LeonardS. You suggested placing the shipping costs under the following, however, there is no business or business expenses with Leonards advice.

- Edit next to your business.

- Add Expenses

How would we add shipping as an expense to a business that does not exist in the filing? It would seem your suggestion would be to file as a business (which we aren't) and then list the expenses separately?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

I would like to add that when I compare these options using another tax reporting software, I see that I can file it as Schedule C if we are small business (which we aren't). OR I can file it under MISC / hobby. If I expand that info, I get something along the following

"Tell us here the gross income you have from a business or investment if you don't run it to make a profit.".

I feel the important take away from that is report income from a business that you don't run to make a profit. That absolutely is our case. My wife is just selling something to turn around a buy something else. She just wants to keep the flow going to enjoy the process of shopping and socialising online with others, i.e. a hobby.

Additionally, If I look up YARD SALE, under another services HELP section, I get the following that states garage sales are informal, private sales of used personal goods. This is absolutely our situation. She is not buying new items at cost to then make a profit. She is buying "yard sale items used" and then selling them shortly after once the novelty wears off. Nor is she's trying to "Flip" items for profit. The service says that yard sale items are not usually taxable. But does acknowledge the occasional item that is considered "collectable" and has an increased value. This is the crux of the problem with these new 1099-K reporting requirements that have started this year as there are a lot of sellers that are essentially online garage sales. It feels like the IRS wanting 1099-K data from online merchants like PayPal makes sense in trying to account for those online businesses that truly exist to make a profit. However, the new changes seem to be now catching all the online yard sellers that are not running a business but are only selling off used goods, usually at a loss in regards to initial cost.

Garage Sales

An informal, private sale of used personal goods.

Receipts from garage sales usually aren't taxable. However, they can be in very unusual cases where you sell an item for more than you paid for it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

I think I have narrowed it down to what the official answer would be for our situation and it correlates to the suggestion of @LeonardS

When I search for "report taxable income from sale of used items", I found a website for Tax law.

https://www.lsnjlaw.org/Taxes/Other-Federal-Tax/Pages/Ga[product key removed].aspx....

The link clarifies that you either have a business or you have a hobby. That it's important to distinguish which of the two best defines your situation.

If your online sales remain a hobby, your expenses cannot exceed the income from the activity. This means that you cannot report a loss. You can, however, deduct your expenses up to the amount of your hobby income. IRS Publication 535 discusses the factors to consider in determining whether your online sales are a business or a hobby. The hobby vs. business debate matters when it comes to self-employment tax obligations and the ability to deduct operating costs.

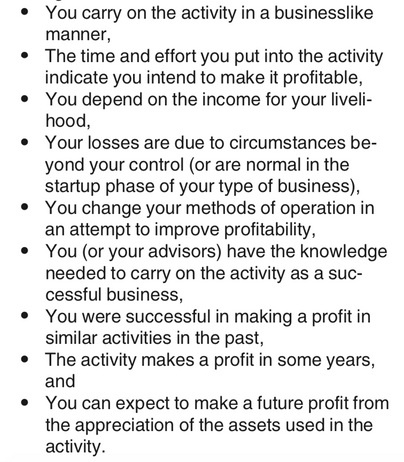

When I review IRS Publication 535, I see that they provide a guide in making this determination.

In determining whether you are carrying on an activity for profit, several factors are taken into account. No one factor alone is decisive. Among the factors to consider are..

Additionally, it goes on to clarify the presumption of profit

Presumption of profit. An activity is presumed carried on for profit if it produced a profit in at least 3 of the last 5 tax years, including the current year.

I can now rest my concerns in knowing that a Schedule C and filling it as business income is not the correct response and that this would in fact be considered a Hobby at this time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

So you are correct, with everything you have described, it does sound as though your wife's activity is a hobby. However, with that said, she cannot deduct expenses. She can only deduct the cost of goods like @Leonard Smith stated. The purse or other items she is buying is her cost of goods. She cannot deduct her selling expenses such as the shipping costs.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

@Vanessa A Thanks for that clarification! That makes perfect sense to me now after researching and the communities help. Thank you for everyone's guidance and time reviewing our situation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

What if you are creating an item to sell? For example you are 3D printing an item...can you deduct the cost of the filament used to create the item?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

Hey Leonard. Thanks for this write up.

Could you confirm..

I realized a while ago that I could buy items on eBay and then sell them to a third party at a profit. Typically, I buy my product for $330 or so and sell for $450. So I make about $120 profit on each one. Not bad right. So according to your instructions (I am not married) I would simply report my own COGS. I dont use eBay to sell them, I have a private business who buys them buy they do pay me via PayPal. I am under the understanding that PayPal will send me my 1099-K. So it sounds like maybe its the same. The 1099-K knows how much I got paid, and the COGS entry would be my records of what I paid for each of them and then via some tax magic Turbotax would do the math on the profit only? Sound right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

Yes, there are instructions on how to do it with tax software in this thread.

You first list the data from PayPal that includes the total as reported to IRS and on that 1099k. (e.g. Gross Profit of 450)

You then list the Cost of goods - (330) which if I recall correctly is listed as a negative number.

The system will then see and list that you have a taxable income of 120 (your actual net profit).

Be sure to keep all records and receipts of your purchases. If you were to get an audit , you can show the actual cost of goods at 330 and be okay. If you don’t have proof, they would say you owe tax on the full amount. So keep records throughout the year instead of trying to get it all together last minute.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife has 1099K from PAYPAL. - not a business

Thank you so much. I have all the records and keep a spreadsheet. What an amazing resource I really appreciate it.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Lily251

Level 2

pangho

Level 2

acutetriangle

New Member

viking

Level 2

pauldughi

Level 1