- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

That is a calculation that is not supported by TurboTax.

It can be properly entered though but only by using the forms mode that is only in the CD/download desktop versions.

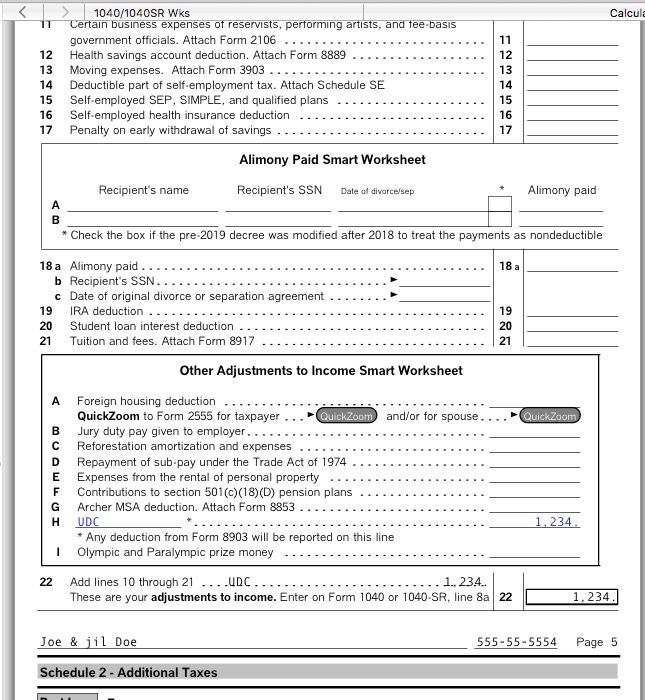

Switch to the forms mode and select the "1040/1040SR" Worksheet and scroll down to Schedule 1 "Other Adjustments to Income Smart Worksheet" line H. Enter UDC and the amount. That is the ONLY way to get it on line 22 of Schedule 1 as required.

Entering as Misc income will put it in the wrong place inviting an IRS audit.

See:

Unsupported Calculations and Situations in the

2019 TurboTax Individual Federal Tax Software Program

19. Legal Fees for Unlawful Discrimination Lawsuits: This is not supported in TurboTax.

**Disclaimer: This post is for discussion purposes only and is NOT tax advice. The author takes no responsibility for the accuracy of any information in this post.**

April 12, 2020

9:00 AM