- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Legal Fees Above the line deductions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Legal Fees Above the line deductions

the program does not seem to allow the above the line deductions for legal fees as found in Page 90 of 2019 1040 instructions:

•Attorney fees and court costs for actions involving certain unlawful dis-crimination claims, but only to the ex-tent of gross income from such actions (see Pub. 525). Identify as “UDC.”

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Legal Fees Above the line deductions

To enter your qualifying legal fees go to

- Wages & Income

- Less Common Income

- Miscellaneous Income

- Other Reportable Income

Enter the for the description "Qualifying Legal Fees" and the amount as a negative number.

This amount will show as a reduction on your tax return.

@EMichael

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Legal Fees Above the line deductions

That is a calculation that is not supported by TurboTax.

It can be properly entered though but only by using the forms mode that is only in the CD/download desktop versions.

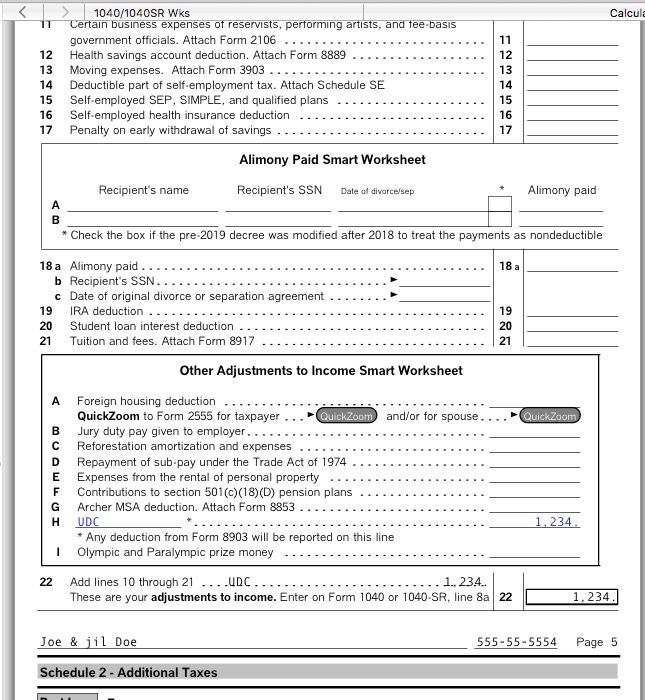

Switch to the forms mode and select the "1040/1040SR" Worksheet and scroll down to Schedule 1 "Other Adjustments to Income Smart Worksheet" line H. Enter UDC and the amount. That is the ONLY way to get it on line 22 of Schedule 1 as required.

Entering as Misc income will put it in the wrong place inviting an IRS audit.

See:

Unsupported Calculations and Situations in the

2019 TurboTax Individual Federal Tax Software Program

19. Legal Fees for Unlawful Discrimination Lawsuits: This is not supported in TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Legal Fees Above the line deductions

Publication 525 at Page 30 states:

"Deduction for costs involved in unlawful discrimination suits.You may be able to de-duct attorney fees and court costs paid to re-cover a judgment or settlement for a claim of unlawful discrimination under various provisions of federal, state, and local law listed in section 62(e), a claim against the U.S. Government, or a claim under section 1862(b)(3)(A) of the So-cial Security Act. You can claim this deduction as an adjustment to income on Schedule 1 (Form 1040 or 1040-SR), line 22. The following rules apply.•The attorney fees and court costs may be paid by you or on your behalf in connection with the claim for unlawful discrimination, the claim against the U.S. Government, or the claim under section 1862(b)(3)(A) of the Social Security Act.•The deduction you're claiming can't be more than the amount of the judgment or settlement you're including in income for the tax year.•The judgment or settlement to which your attorney fees and court costs apply must occur after October 22, 2004."

The program does not allow such an entry to be placed on the dotted line, identified as UDC and added to the total above the line deductions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Legal Fees Above the line deductions

To enter your qualifying legal fees go to

- Wages & Income

- Less Common Income

- Miscellaneous Income

- Other Reportable Income

Enter the for the description "Qualifying Legal Fees" and the amount as a negative number.

This amount will show as a reduction on your tax return.

@EMichael

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Legal Fees Above the line deductions

That is a calculation that is not supported by TurboTax.

It can be properly entered though but only by using the forms mode that is only in the CD/download desktop versions.

Switch to the forms mode and select the "1040/1040SR" Worksheet and scroll down to Schedule 1 "Other Adjustments to Income Smart Worksheet" line H. Enter UDC and the amount. That is the ONLY way to get it on line 22 of Schedule 1 as required.

Entering as Misc income will put it in the wrong place inviting an IRS audit.

See:

Unsupported Calculations and Situations in the

2019 TurboTax Individual Federal Tax Software Program

19. Legal Fees for Unlawful Discrimination Lawsuits: This is not supported in TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Legal Fees Above the line deductions

Thank You! Simple to do and worked perfectly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Legal Fees Above the line deductions

Thank you.

That worked perfectly and made the tax form filled out per the instructions.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

karlameyer

Level 1

BobK59

Level 2

kyle-williams-ny

New Member

Noxlord1234

New Member

olegyk

Level 1