- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

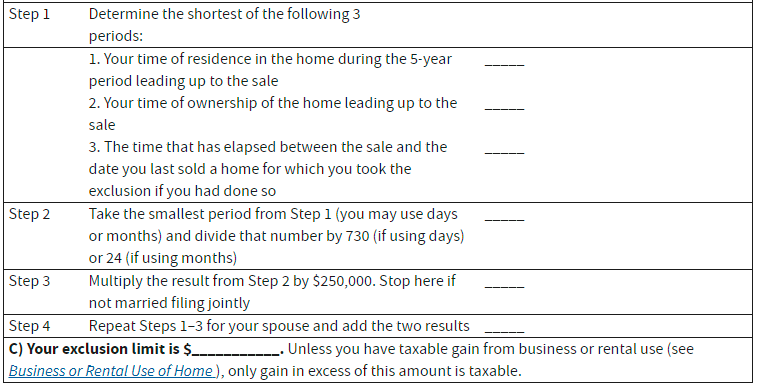

The exclusion is based on the fraction of months (or days) your wife lived there, so 1.5/2 is ~75% of $250,000 or $187,500.

Don’t forget to add improvements. Any improvements can be added to your cost to reduce taxable gain.

Related Resource:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 9, 2021

5:24 PM