- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have tax exempt interest and I entered each state on the Federal Return but it is not adding it to NC D-400 or D-400 Sch S. How do I fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

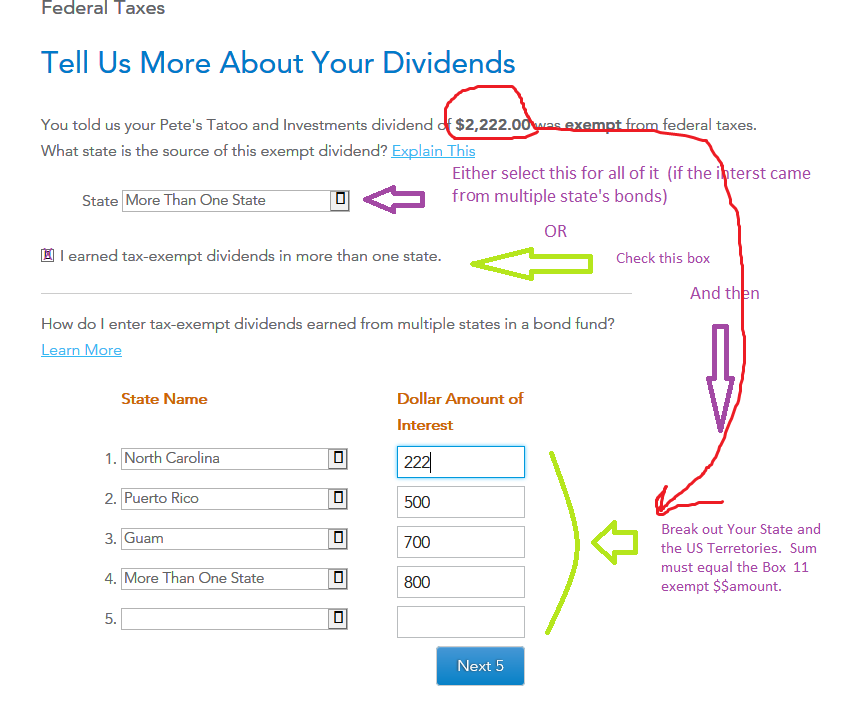

Not sure what you did...but to make sure, you only enter the NC amount and any US Territories (like Puerto Rico) in the federal section for that form, and all the other states are lumped together as one total.

.......so you might need to entirely delete the form type where you entered it in the Federal section (1099-DIV or 1099-INT?)...then re-enter it again....only doing the break-out of states as follows:

NC...……………...100

PR...………………..50

Multiple States.....850

_________________________________

The Multiple States selection is at the very end of the list of states when selecting them.

(for others...the desktop software uses the term "More than one state" )

______________________

That "should" work, and show up on line 1 of the D400 Sch S. That Line 1 will contain $$ from both box 11 of the 1099-DIV, and box 8 of the 1099-INT (& occasionally a form K-1)

______________________________________

Here's another example of what the followup page should look like in the Federal section for a 1099-DIV with box 11 $$ in it: