- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

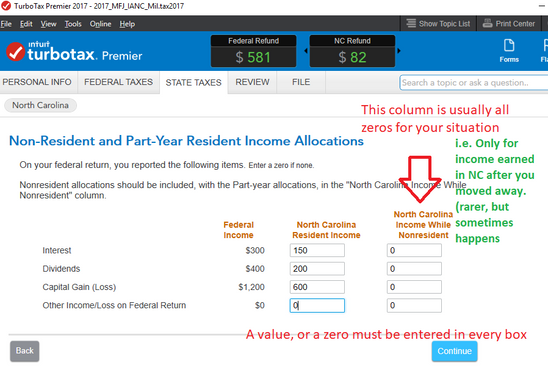

Most states do not proportionally allocate based on date...Most state's Part-Year tax returns require you to step thru the entire part-year tax return to "allocate" how much of the year's federal income belongs to that particular state.

Naturally the respective states want to know what date you moved in...or out (should they ever decide to audit your income "claims" ), but you have to run thru the entire part-year interview for that state to do the allocations.

An example for one of my NC tax returns is shown below...MD should be somewhat similar, but I can't know exactly what they display for MD.

_________________

_______________

____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.*

June 18, 2019

3:29 PM