- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

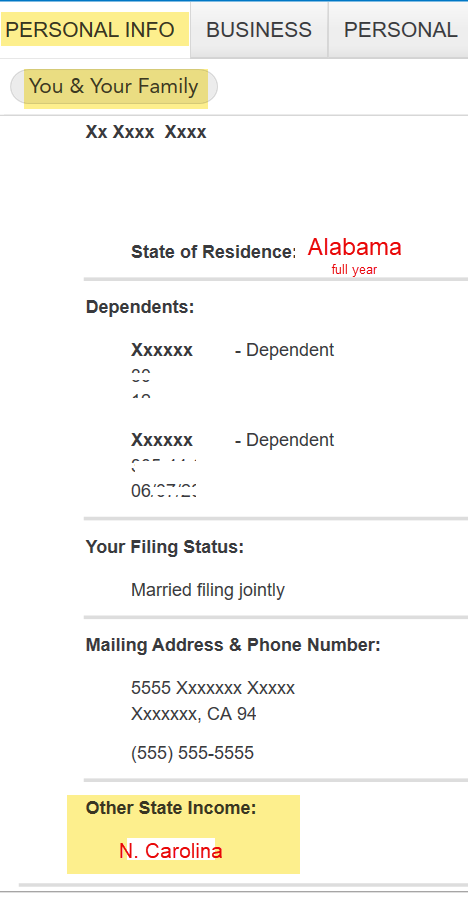

You should file a non-resident return for NC. If you went to NC to work during the summer and then you returned back home to AL - your trip would be considered temporary. You were not a resident of NC so you don't have to do part-year returns. Short term stays that you intend to return home from are not permanent moves. The temporary residency can be for school, work, medical reasons, incarceration, etc....

Do I have to file tax returns in more than one state?

Why would I have to file a nonresident state return?

How do I file a nonresident state return? - - Follow these instructions - do not indicate that you moved and check the box that says I have Other State Income.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 31, 2025

6:43 PM