- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Use TurboTax CD/Download to enter charitable contributions directly into the California section.

There is no option in TurboTax Online to enter itemized deductions directly on the California section. All deductions entered in Federal are carried to California. TurboTax automatically gives you the higher of the California standard deduction or itemized deductions, regardless of what deduction you used on your federal return.

If your refund did not change after you entered your charitable contributions, it means the California standard deduction is still giving you a better tax result.

To view your forms in TurboTax Online:

- Tap Tax Tools in the left column

- Select Print Center. Once you pay you can view your forms

You can compare California Schedule A with and without your charitable contributions by printing your return twice.

TurboTax CD/Download allows you to view forms in the Forms mode.

To enter charitable contributions directly onto California:

- Transfer your return to CD/Download. See How do I switch from TurboTax Online to TurboTax CD/Download?

- Once your return is installed, top Forms in the top right corner

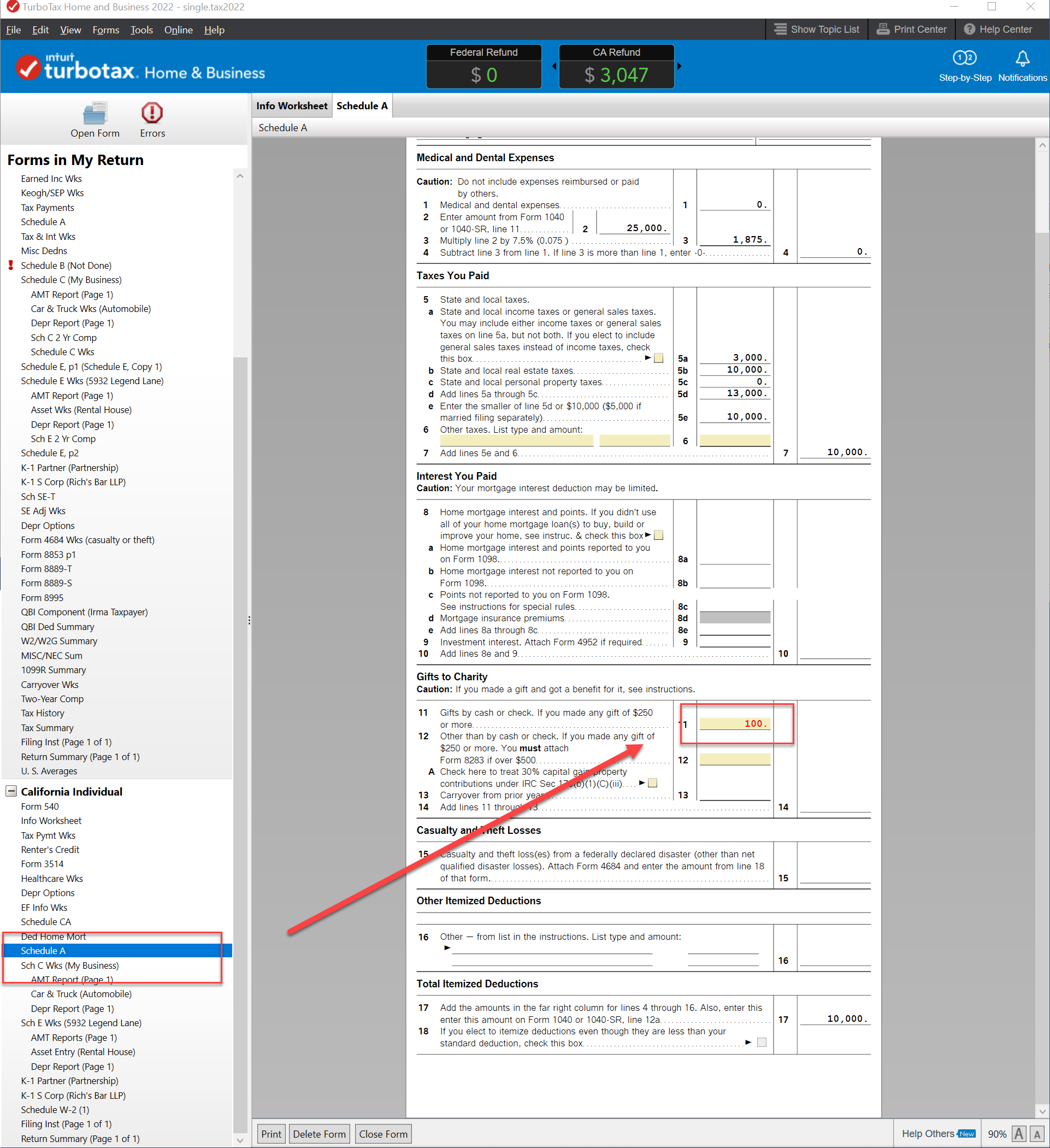

- In the left column, find Schedule A under California Individual and tap to open

- Enter a non-cash gift in Box 12.

- If are making a cash donation, highlight Box 11 and right-click and select override or type CTRL+D on your keyboard. Enter you donation. An override will prevent you from e-filing your California state return and voids the 100% Accurate Calculation Guarantee.

- Tap Step-by-Step where Forms used to be to return to the interview mode.

**Mark the post that answers your question by clicking on "Mark as Best Answer"