- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

You should claim the actual time spent in Oregon and the income that you have records to back up. If you work 60%-65% in Washington then your Oregon wages would be 35%-40% of the total, not 50%.

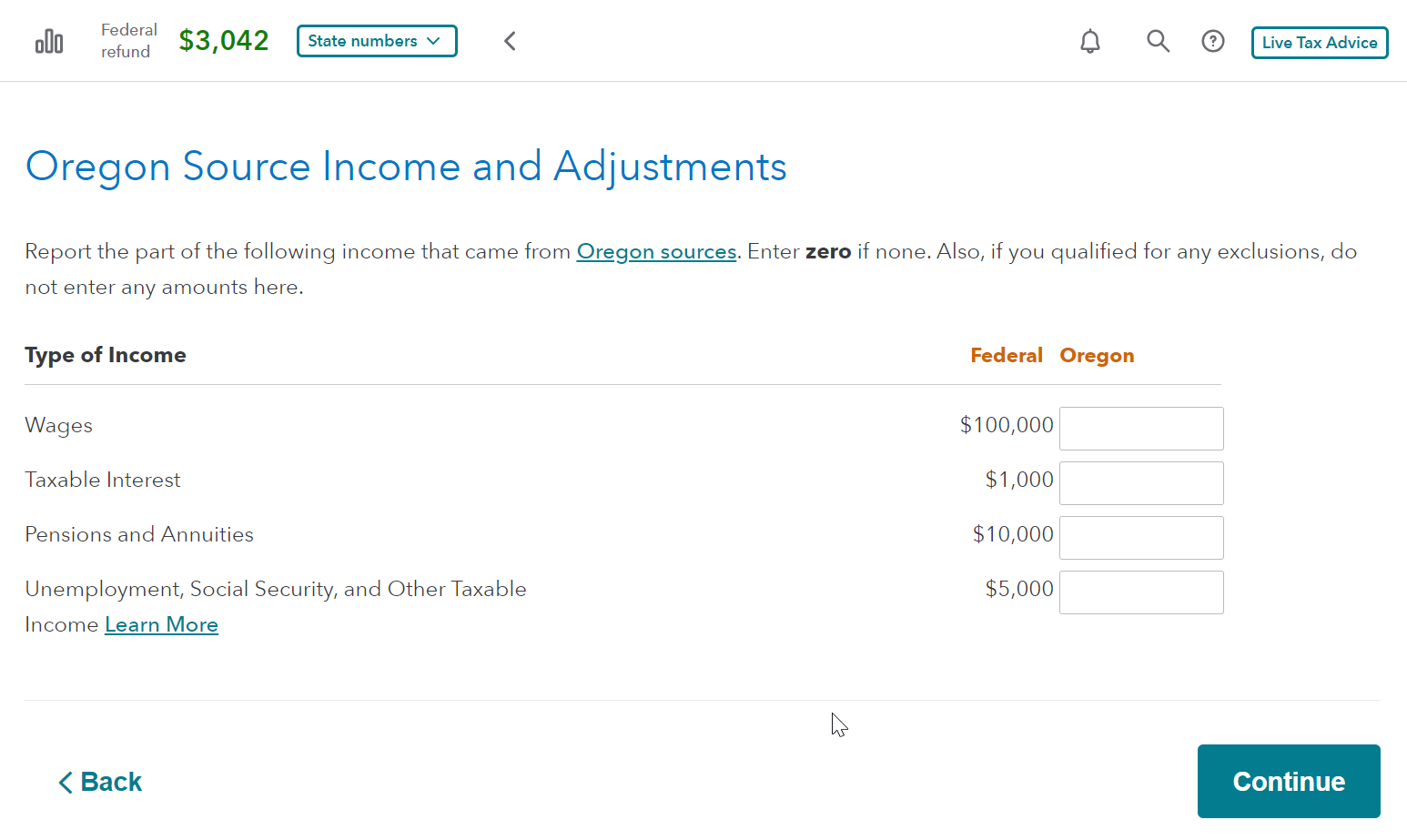

Adjust your earnings in the Oregon section of TurboTax, not on the W-2.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 27, 2023

5:11 AM