- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

For tax-exempt interest from other states, that transfers from your entries in the Federal section for any 1099-DIV forms you entered that had any box 11 $$ on that -DIV form.

_________________________

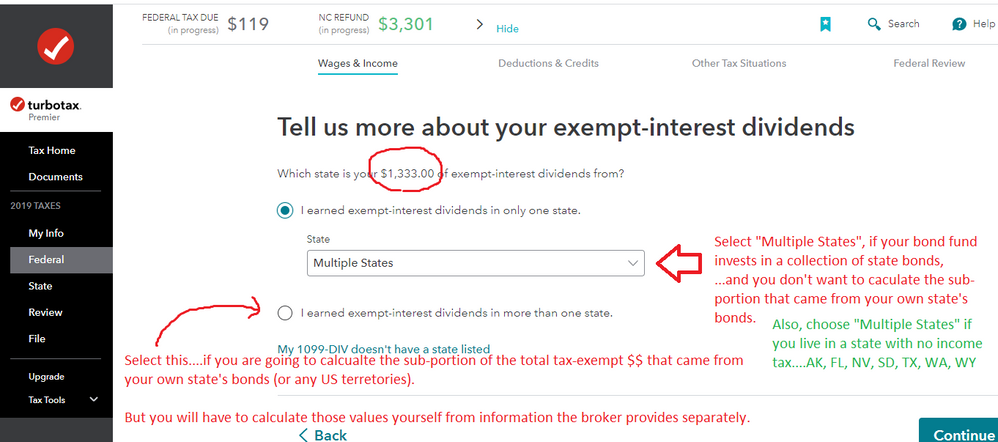

For example, if you don't bother to break out any LA-bond $$ (you are not required to), then you just tag all of box 11 as being from "Multiple States" on the follow-up page that asks about what states produced the $$ in box 11.

______________________________________________

________________________________

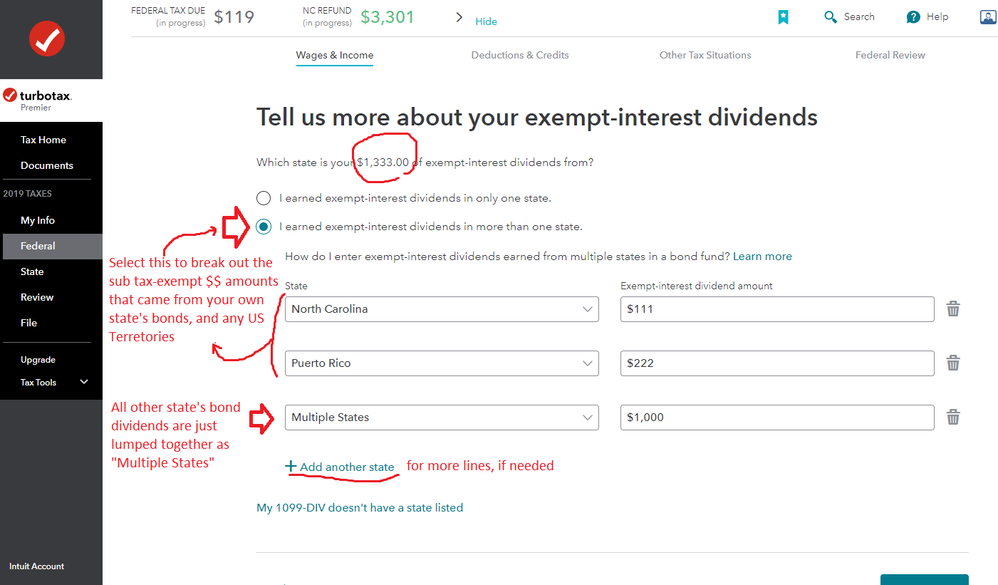

OR...if you do have the information needed to calculate what sub-$$ amount came from LA bonds, you would break that down as follows....but for low LA $$ amounts, it may not do much and may not change your LA taxes at all.

(Example is for an NC resident)

_______________________________