- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

File a non-resident Maryland income tax return to get your Maryland withholding back.

The credit for taxes paid to another state is for double-taxed income. You do not have double-taxed income if you lived and worked in PA for all of 2020. You have a withholding mistake by your employer.

Maryland says:

If Maryland tax was withheld from your income, you must file to obtain a refund of the withholding. Complete all of the information at the top of Form 505 through the filing status, residence information and exemption areas.

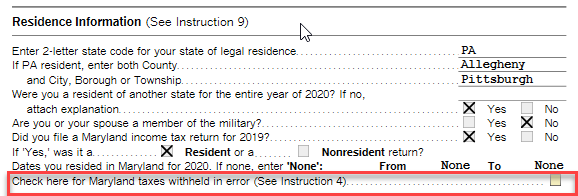

Check the box provided to the right of the residence information for you to indicate your withholding was withheld in error.

Enter your federal adjusted gross income on line 17 in both columns 1 and

3 and line 24. Then complete lines 43-47, 49 and 51.

Sign the return and attach withholding statements (Forms W-2 and/or 1099) showing the Maryland tax withheld equal to the refund you are claiming.

See Maryland Tax withheld in error on page 2 of the 2020 Nonresident Booklet.

TurboTax Online does not handle this situation. You may want to complete Form 505 using the state fill-in form. Or you can print out your MD return and fix it. There's no match. You will just have to white out some boxes and check the withheld in error box.

If you are using CD\Download, after completing the MD section, click on Forms in the upper right. Find Form 505 in the left column (Forms in My Return). Check the box "Check here for Maryland taxes withheld in error" and print your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"