- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

No. For TurboTax Online, please follow the instructions on the page How to amend (change or correct) a return you already filed.

Then, if you are qualified, and did not previously get the stimulus payments, you must enter $0 for both payments so that the Recovery Rebate Credit calculates correctly.

Please follow the steps below:

- With your return open, search for stimulus with the magnifying glass tool on the top of the page.

- Select the Jump to Stimulus in the search results to directly go to correct TurboTax page.

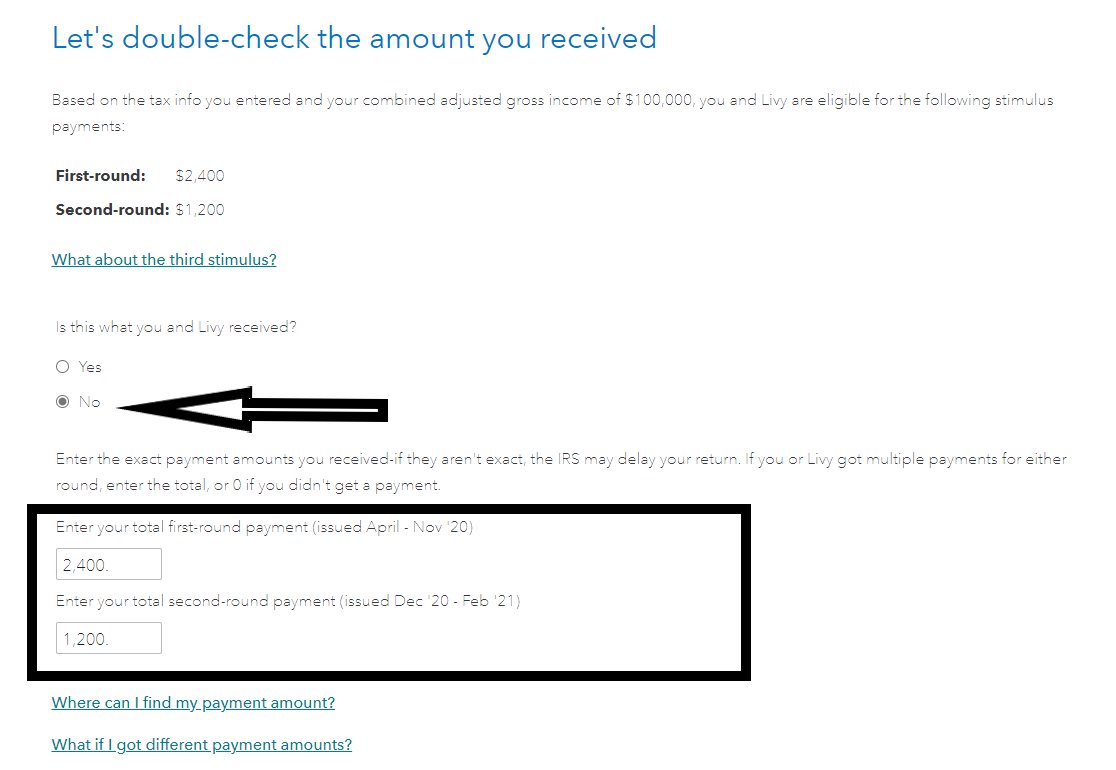

- You will come to a page titled Let's double-check the amount you received and it will list the first-round and second-round payments based on your 2020 return.

- Answer No for the question, Is this what you received?

- Enter the amounts of the first and second round stimulus payments you received, which would be $0 for both boxes. I have attached a screenshot below for additional guidance.

If the Recovery Rebate Credit is still not populating, then please review the requirements below to ensure you, your spouse and your dependents (if applicable) do qualify to receive the stimulus payment.

To qualify, you must:

- Be a US citizen or resident alien.

- Not be claimed as a dependent on someone else's tax return.

- Have an 2020 Adjusted Gross Income (AGI) up to $75,000 for individuals and up to $150,000 for married couples filing joint. If your AGI is above this amount, your payment will be reduced.

In addition, per the IRS, to be a qualifying child of an individual for purposes of the payment, generally the individual must live with the child for more than half of the tax year, the child must not provide over half of his or her own support for the calendar year, and the child must not file a joint return for the tax year. The child also must be the individual’s child, stepchild, eligible foster child, sibling, grandchild, niece, or nephew. In addition, to be claimed as a qualifying child, the child must be a U.S. citizen, permanent resident or other qualifying resident alien. The child must be under the age of 17 at the end of the year for the tax return on which the IRS bases the payment. Also, a qualifying child must have an SSN valid for employment or an adoption taxpayer identification number (ATIN). A child who has an ITIN is not a qualifying child for this payment.

For more information, please see Calculating the Economic Impact Payment.

The IRS will continue to issue the 2021 Economic Impact Payments throughout 2021. If you are qualified, the third stimulus payment should be paid once your 2020 return is processed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"