- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I modify Schedule 3? I should not have an entry on line 12e, but I do, and I cannot modify the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Schedule 3 is a new form that reports Nonrefundable Credits on your Form 1040.

I have attached a screenshot below that shows the items included

In order to claim any of the Nonrefundable Credits on this form, you will need the Schedule 3.

While I'm unsure of your unique tax situation, I can help guide you to where you can see if any information from Schedule 3 has been transferred to your Form 1040. You may not be able to delete it because you have entered information that requires it.

When logged into TurboTax Online

1.) Click Tax Tools on the left-hand side navigation bar

2.) Click Tools

3.) Click View Tax Summary on the window that pops up

4.) On the left-hand side navigation bar click Preview my 1040

5.) Scroll down to line 12. If the box is checked on line 12b, then Schedule 3 is required based off of your entries.

"ChristieB New Member"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

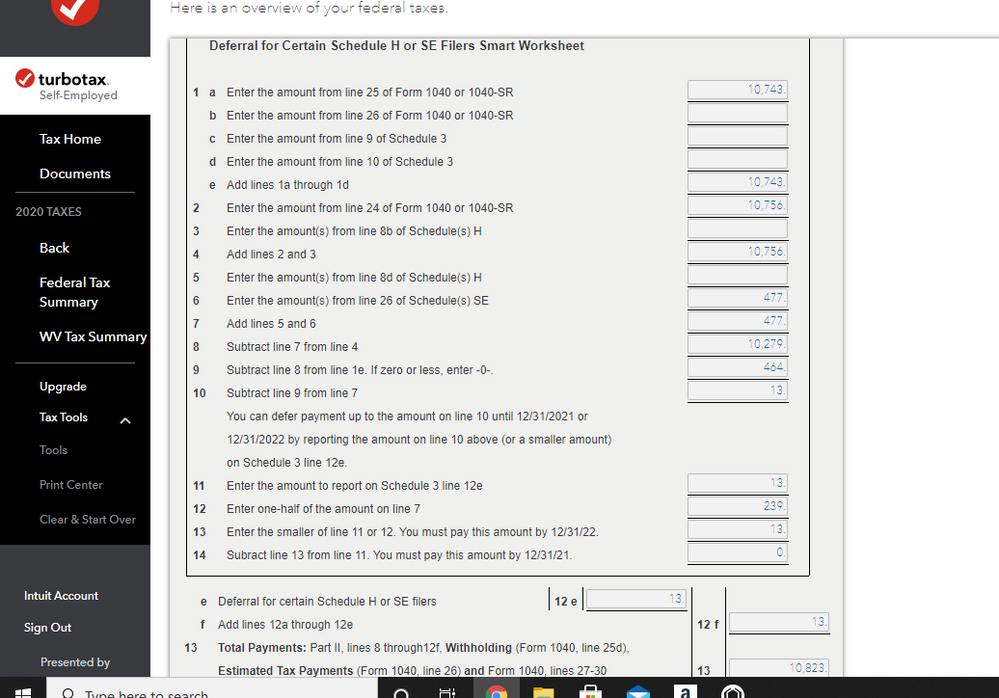

My question and situation is specific to the worksheet to defer certain taxes for Schedule SE filers. I've attached a copy of the worksheet to help explain. Even though the worksheet shows that I can defer $13 of my self-employment tax until 2022, why would I want to do that? Isn't this deferral optional? Also, since I am getting a Federal refund of less that $100, shouldn't that cancel this deferral? Why would I defer and still get a refund? I would prefer to remove this worksheet and remove Schedule 3 and pay the $13 tax. I cannot figure out how to do that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Yes, the deferral is optional. To delete this worksheet, you need to update TurboTax with a refreshed Sch SE-T while also removing any prior acceptance of the S-E tax deferral option.

First, delete Sch SE-T that applies by following these steps:

- In Forms Mode, scroll to Sch SE-T and select it to open.

- In the lower left corner, select Delete Form and confirm the deletion.

Next, to replace Sch SE-T, return to the self-employment income & expenses interview in the Business tab section and select Edit/Add.

- Select Edit for your business.

- Scroll down to Done so that the Sch SE is recalculated.

- Finish any other questions in the self-employment interview and click Continue.

Lastly, revisit the section for the Self-employment tax deferral entry:

- Return to the Deductions & Credits section.

- Scroll to Tax relief related to COVID-19 and Show More.

- Select Self-employment tax deferral and select Revisit.

- Answer Yes at the next screen to get back to Let's start by getting your eligible income.

- If you do not want to defer any self-employment income, "Enter your eligible self-employment income" should be blank.

- Select Continue.

- At Tell us how much you'd like to defer, "Enter amount" should be blank.

- Select Continue.

- If you do not want to defer any self-employment income, "Enter your eligible self-employment income" should be blank.

- Scroll down and select Wrap up Tax Breaks and Continue.

- Run through the Federal Review again.