- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

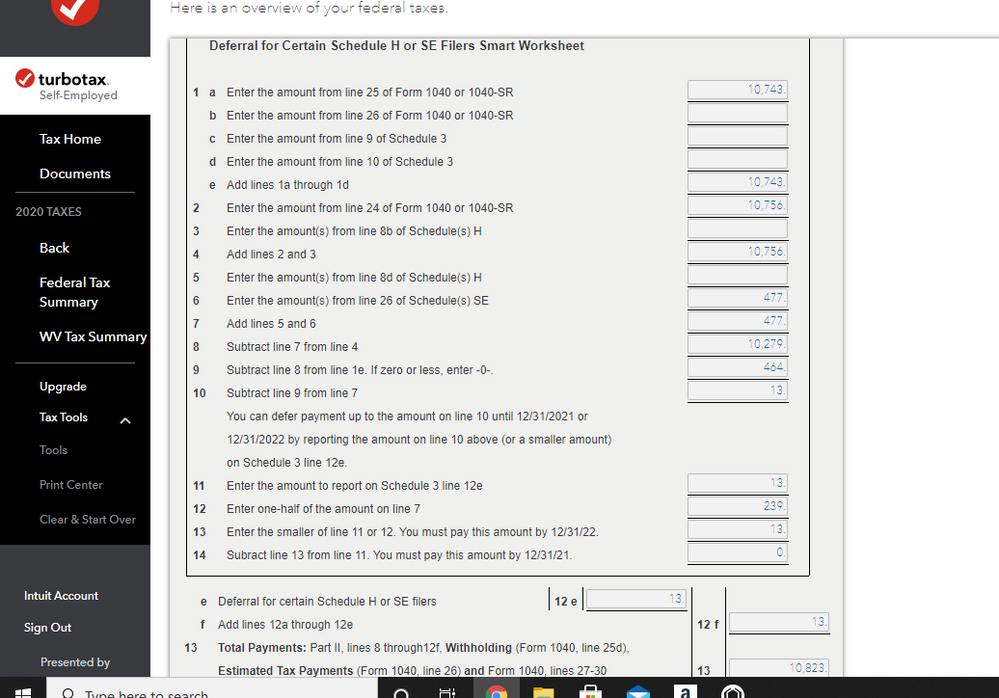

My question and situation is specific to the worksheet to defer certain taxes for Schedule SE filers. I've attached a copy of the worksheet to help explain. Even though the worksheet shows that I can defer $13 of my self-employment tax until 2022, why would I want to do that? Isn't this deferral optional? Also, since I am getting a Federal refund of less that $100, shouldn't that cancel this deferral? Why would I defer and still get a refund? I would prefer to remove this worksheet and remove Schedule 3 and pay the $13 tax. I cannot figure out how to do that.

February 9, 2021

4:09 AM