- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer Kind - None Apply

I use TurboTax Home & Biz via Windows, but the preparation of 1099s occurs on an Intuit website, quickemployerforms.inuit.com.

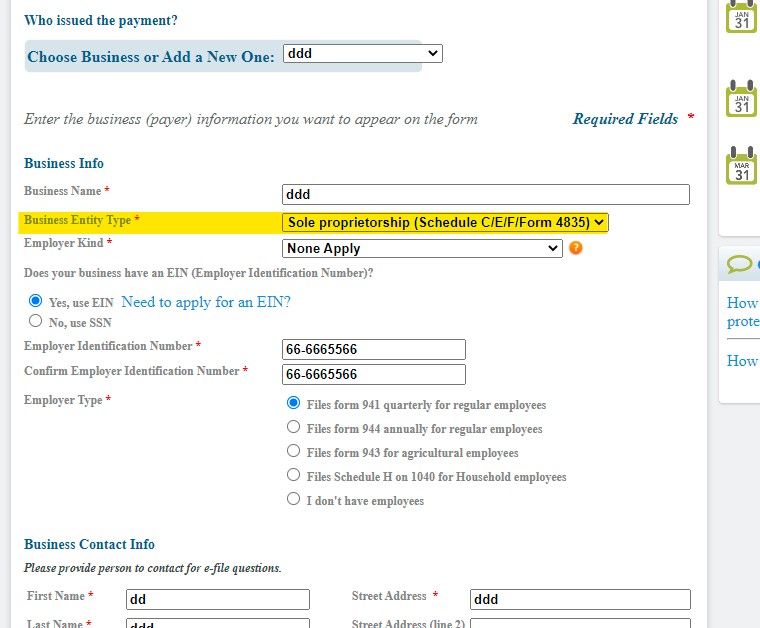

I am unable to create a 1099-NEC at quickemployerforms.intuit.com. When answering the drop down for "Employer Kind", a required field, I select "None Apply", because none of the other options apply.

That stops the process immediately because when I go to create the form, I get an error message, "Invalid Entry: Employer Type is Required".

Yet my employer type, which I selected, is in fact "None Apply", which is one of the possible answers.

This needs to be fixed!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

What choices do you get? I don't remember that question. I do my self employment business with just my ssn. Obviously you have to pick something.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Choices are:

- None Apply

- Federal Government

- State and Local Governmental Employer

- Tax Exempt Employer

- State and Local Tax Exempt Employer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Here's what happens if you selecte "None Apply". I've tried with both Chrome and Edge browsers.

https://www.screencast.com/t/wDQCGnho

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

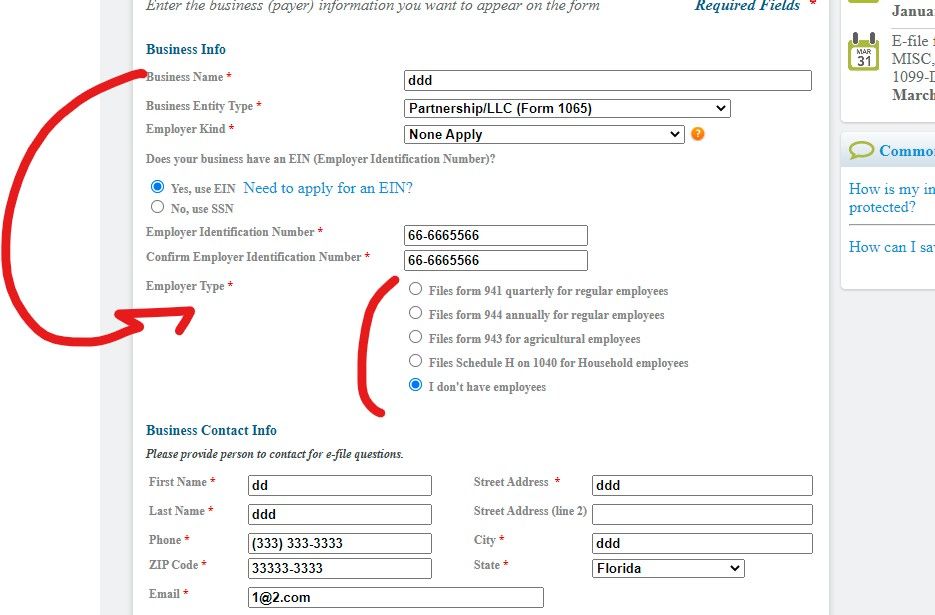

None apply is allowed but the line before must be filled in ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thanks, Business Entity Type is selected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Employer type and employer kind are not the same thing. Did you make a choice from this list ?