- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

There was no such change ... the property should have been fully depreciated by now (if you started renting it in 1993) so your gain on the rental is all recapture of depreciation capped at 25%.

The one sale will be reported in 2 parts ... the rental portion on the Sch E and the personal portion on the Sch D.

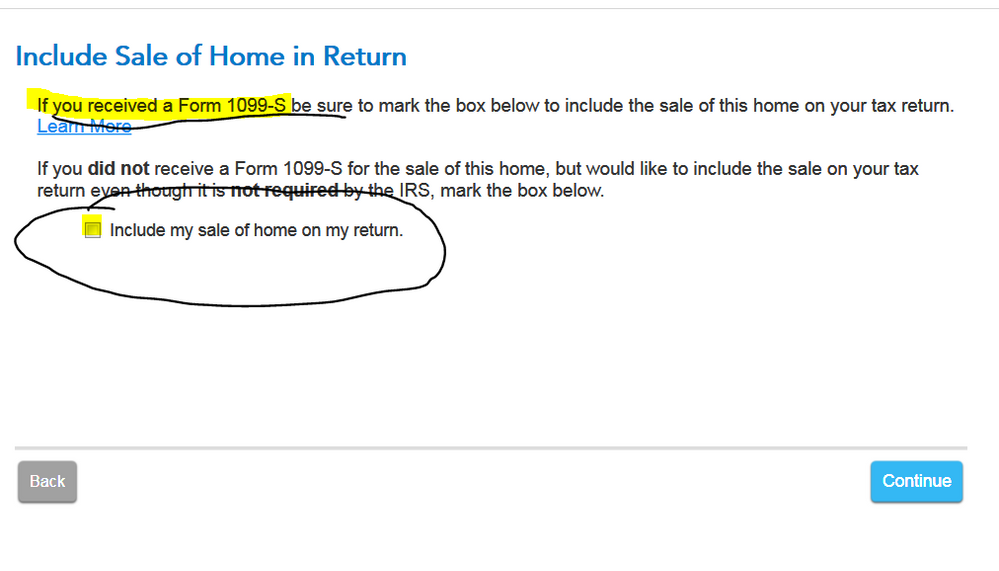

Also remember that the land value remained with the personal residence so if you peeled off the $100K from the original $260K then the basis in the personal portion started with $160K and since you will sell for $500K there is no tax on the personal portion however you MUST report the personal sale since you will be issued a 1099-S at the closing of which a portion will be reported on the rental and the rest on the Sch D ... you MUST click this box in the home sale section.