- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I worked for a scumbag who didn't report me working as an independent contractor for his company to the IRS, I need his EIN to finish taxes but he's not giving it. Help?

I've tried asking him for my 1099 several times and I've waited months for it to appear. It hasn't. I went to the local IRS office and they didn't have any information. I can't finish filing my taxes without it... So what can I do and how do I finish my taxes?

Topics:

June 29, 2021

7:00 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

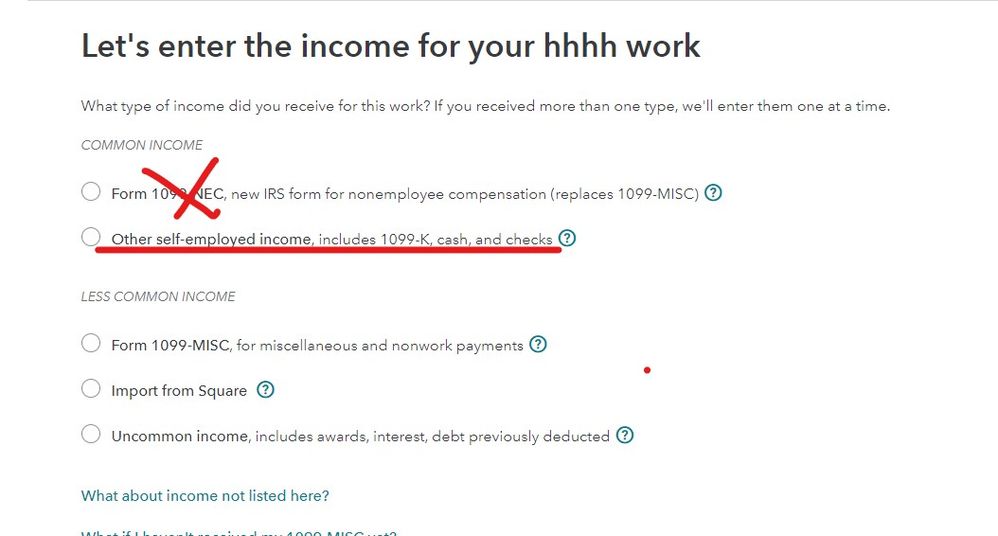

Do you know the amount? Just enter it as Other self employment income or as Cash or General income. You don't need to get a 1099NEC or 1099K. Even if you did you can enter all your income as Cash. Only the total goes to schedule C.

How to enter income from Self Employment

June 29, 2021

7:03 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Agreed ... skip the idiot and simply report all your income on the Sch C and just skip the 1099 entry section ...

The fact that he has failed to issue 1099 forms is HIS problem when he is audited not yours if you simply report all your income on your Sch C and this will CYA.

June 29, 2021

7:08 PM

282 Views

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I thank you both from the bottom of my heart. I was finally able to finish my taxes today.

July 1, 2021

3:29 PM