- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@slash wrote:

Thanks for responding. Do you know what line to look at on TT to see what, if any, refund I'll be getting back related to the unemployment credit?

If the tax return was filed after March 26, 2021 and you entered unemployment compensation then the exclusion would have been calculated by TurboTax if your Adjusted Gross Income was less than $150,000.

So you would not be receiving a separate tax refund from the IRS for the exclusion.

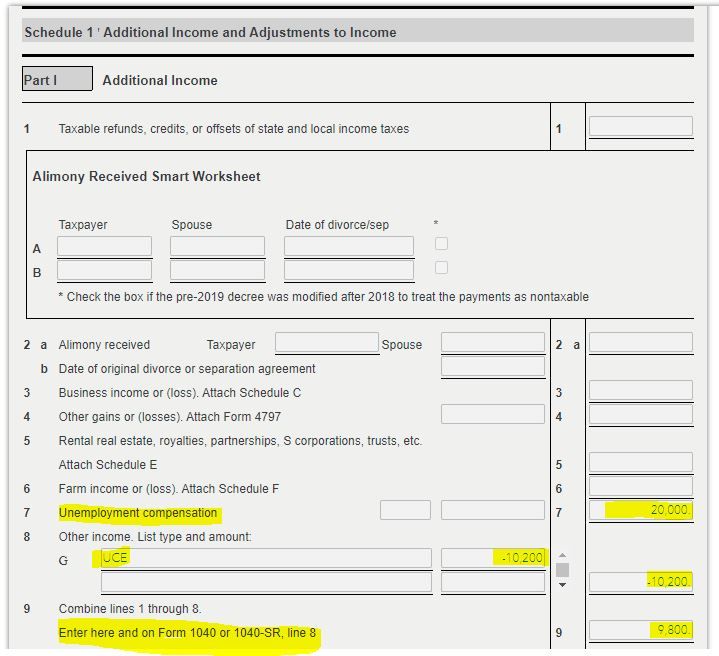

The exclusion is reported on Schedule 1 Line 8 as a negative number. The unemployment compensation received is on Line 7 of Schedule 1. The result flows to Form 1040 Line 8.

June 21, 2021

9:28 AM