- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

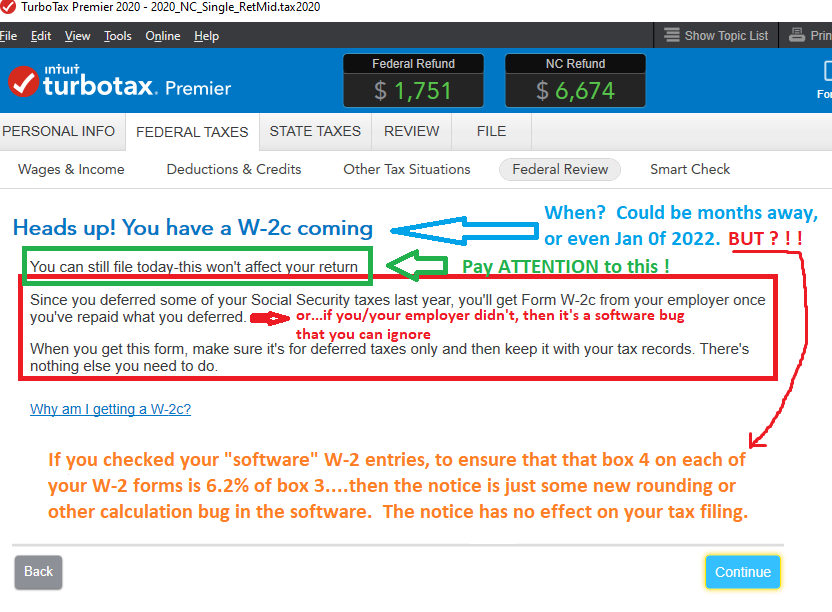

Some folks are getting that if they also had a 1099-NEC form in addition to a W-2

IF not that...

could be a simple rounding difference in box 4. Try adding 50cents to box 4 on any W2 that has nearly 50cents on the final digits and see if the Warning/Notice (and that's all it is) still occurs.

IF it does, then that is what's going on...i.e. just a rounding difference between what your employer did, and what TTX did.

Then return box 4 to it's former # and ignore that notice/warning.

__________________________

I tested my desktop software.....and for my test, in a situation where the 6.2% was close to $$$$.50..... a value of $$$$.49 in box 4 gave me the warning, and $$$$.50 did not....and that's all a rounding issue.

_________________________________________________