- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Are you eligible for the plug-in electric vehicle credit?

Taxpayers are allowed a credit for the purchase of plug-in electric drive vehicles used for either business or personal purposes. The credit, which ranges between $2,500 and $7,500 for light-duty vehicles, varies depending on the weight of the vehicle and kilowatt hour of battery capacity.

The credit phases out for each car manufacturer when they reach a total of 200,000 electric cars sold for use in the United States.

To determine if you are eligible, click on Deductions & Credits under the Federal menu. Under Cars and Other Things You Own, choose Start/Revisit next to Energy-Efficient Vehicles. This credit is reported on Form 8936.

Plug-In Electric Drive Vehicle Credit

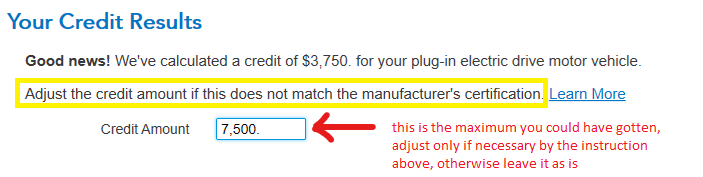

Be sure that you do not change the maximum credit amount shown on the screen, otherwise the calculation will not be correct.

TurboTax will calculate your maximum credit based on the details entered for your vehicle and any applicable phase-out based on the purchase date.

On the screen where it shows the amount of credit you qualify to receive, the box at the bottom of the page is showing the maximum credit that would have been allowed for your vehicle had a phase-out not applied. Your credit may be limited by the phase-out. If you change the number on that screen, your credit will not be calculated correctly.

The information on the screen says this field is for adjusting the amount of maximum credit it is does not match the manufacturer's specification. The number entered here will be the maximum credit that you may receive prior to any limitation being applied. If you change it, your credit will be based on the number entered.

Refunds cannot be issued on this forum. If you need assistance, you may contact TurboTax Support.

What is the TurboTax phone number

**Mark the post that answers your question by clicking on "Mark as Best Answer"