- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

If your dependent son made less than $1,300 in interest, dividends, and capital gains distributions combined, and that was his only source of income, then his income doesn't need to be reported on your (or any) tax return.

Your dependent children must file a tax return if they earn certain amounts of income during the year.

Taxpayers claimed as dependents have different filing requirements than those that are not claimed as dependents, so you should make sure that your child is eligible to be your dependent.

Dependent children who have earned income of more than $14,600 of income in 2024 generally must to file an income tax return and may owe income tax. Earned income applies to wages and salaries your child receives as a result of providing services to an employer or from self-employment, even if only through a part-time job.

The rules for filing a tax return do change when your dependent child receives income from sources other than employment, such as investment income including interest and dividend payments. For 2024, if the total investment income is in excess of $1,300, then a tax return must be filed for your dependent child.

If this is not the case you can report his interest income as reported on his Form 1099-INT:

- Open/continue your tax return you will enter it in the "Child Income" section of TurboTax :

- If you are using TurboTax Online/Mobile: Click on this link: child income.

- If you are using TurboTax Desktop: Click on the search icon in the top right of your TurboTax screen, Type "child income" in the search box and click on "Jump to child income"

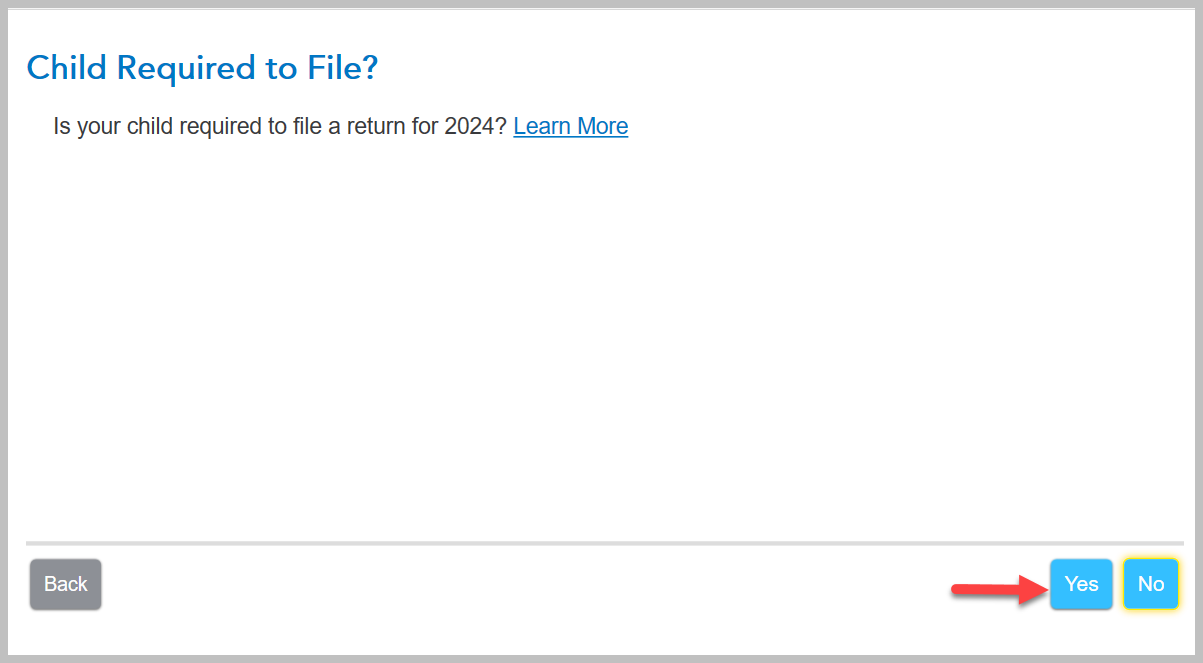

- TurboTax will ask you questions to determine if your son's income needs to be reported on a tax return. You may be able to report it on your return or their return.

Your screen will look something like this:

Click here for "Do I need to report my child's 1099-INT on my return?"

Click here for "Tax Filing Requirements for Children"

**Mark the post that answers your question by clicking on "Mark as Best Answer"