- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

An exchange traded fund (EFT) is treated like any other sale of an investment. Any sale or exchange is treated as a taxable sale for income tax purposes. Here are the necessary details to report your sale(s).

- Cost basis

- Date of purchase

- Date of sale

- Sale proceeds.

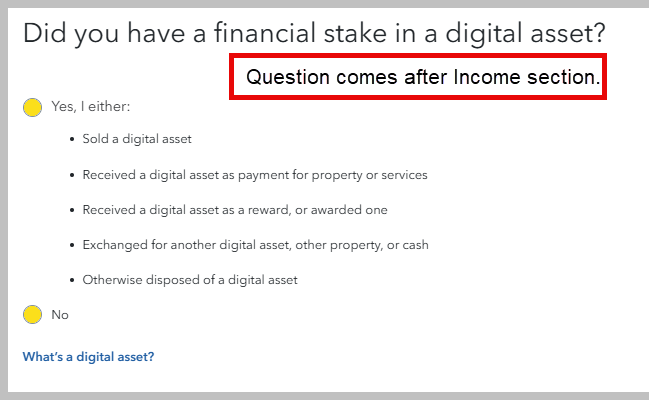

A question will come up after your finish your income section of the return:

- Since your EFTs hold crypto, then you should select 'Yes' 'Did you have a financial stake in a digit asset?'

Report this sale of EFTs as an investment sale: Where do I enter Investment Sales?

- Open or continue your return.

- Navigate to the investment sales section:

- TurboTax Online/Mobile: Go to investment sales. If using this application, make sure it is open

- TurboTax Desktop: Search for investment sales and then select the Jump to link.

- Or Personal Tab > Continue > I'll choose what I work on > Scroll to Investment Income > Select Stocks, Cryptocurrency, Mutual Funds, Bonds, Other

- Answer Yes to the question Did you sell any of these investments in 2024? (or Okay! to Time to kickoff your investments!).

- If you land on the Investment sales summary or Your investments and savings screen, select Add More Sales or Add investments.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 8, 2025

10:37 AM