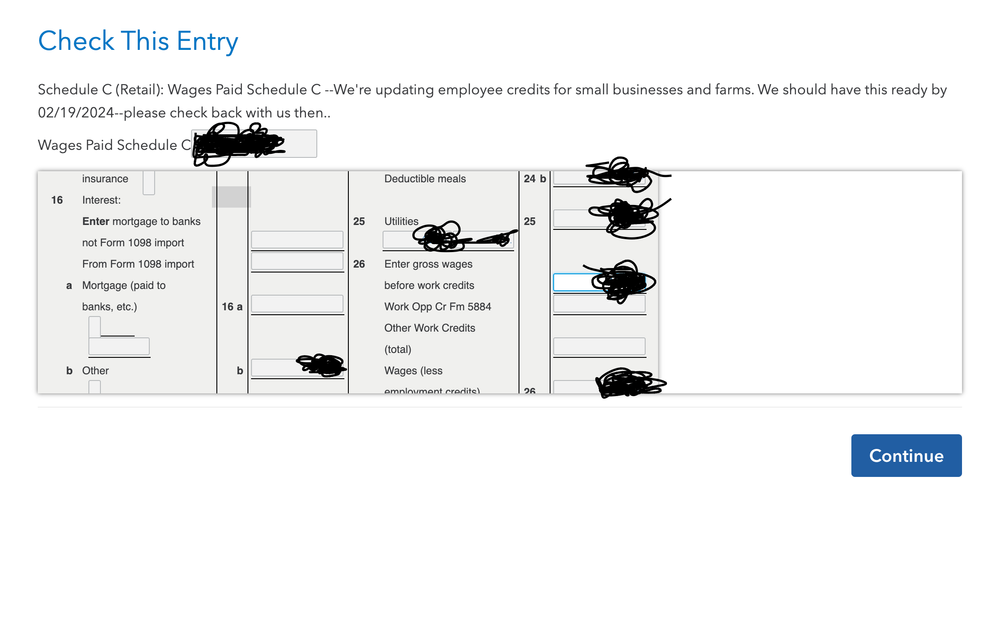

Your Schedule C may be held up by the release of Form 8881, Employee Credits for Small Businesses and Farms, which is due on February 21, 2024, and applies to any business reporting wages. Update your software the next day (if using TurboTax for Desktop), run Review again. The forms hold should be released.

Thank you! Just wondering, why the delay? We have not experienced this the past few years.

As of 2/17/24 I received the same error, now it says "We should have this ready by 2/24/24"

Although the error regarding Form 7206, self employed insurance (not being able to e-file) has now been removed.

Any idea when this gets fixed? Still having issues. Thanks.

Same issue. Anyone know when this will be resolved? They keep pushing the date and now its showing 3/2/24 to be resolved. so inconvenient.

The latest update we have as of today is that Form 8881 should become available on March 6, 2023.

The TurboTax forms availability tool provides the company's best estimate of the date the forms will be ready to use in the program. Programmers need to update TurboTax every time the IRS or a state agency updates a form.

Can anyone confirm that this isn't a problem at HR Block? I'm thinking about jumping ship because they keep pushing the date. Now March 2nd

I did the exact same thing and filed with H&R Block yesterday. Both my federal and state has been approved. Seems only Turbo Tax has this issue.

What was your cost at H&R, hundreds of dollars? and did you just print your forms off of turbo tax and take with you? I'm not sure I would trust someone at HR to do my taxes lol

Lol me either. But no. I did them online. They have self service like Turno tax. They asked who I filed with last year and when I put turbo tax, they sent a QR code for me to sign into TT and they imported my info from TT to their system. It was very easy. I have small businesses so it cost me $161 because i also opt in to have my federal pay my h&r fees

Interesting, I had no ideal HR had online and it would just transfer over. I will wait until 3/3/24 per my error code date although after that, I will have to do something else too. I spoke with our accountant here at my work and he said their software has no issue either, so it is definitely TT.

Thank you for the information