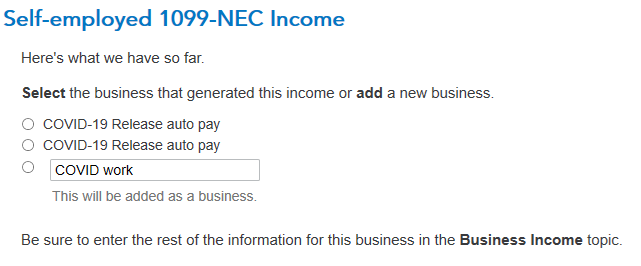

This applies to Form 1099-NEC also.

Enter it in the personal section, Other Common Income Form 1099-MISC. To ensure it does not go to Schedule C (self-employment), you will answer the follow-up questions accordingly.

On the Describe the reason for this 1099-MISC screen, enter a description of the other income. (award/stipend)

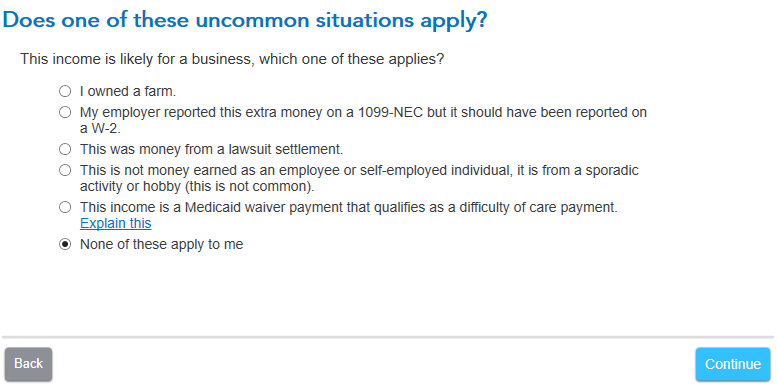

Select None of these apply on the Does one of these uncommon situations apply? screen.

Select No, it didn’t involve work like my day job on the Did the involve work that's like your main job? screen.

Select I got it ONLY in 2023 on the How often did you get income for? screen.

Select No, it didn’t involve intent to earn money on the Did the work involve an intent to earn money? screen.

Answering differently to any of these questions will imply self-employment and generate Schedule C.

Please give feedback. If this helps click “Thumb” or “Best Answer” if it’s a solution.