On irs.gov all of the bars have disappeared and there had not been any change in 20 days. I check today and Tax topic 152 is gone, but my refund amount is visible (it was not previously). What does this mean?

I got accepted on the 14th of january and its saying still processing waiting on refund date but i had topic152 that disappeared too thats mean im still getting my refund direct desposit

Same thing here. Bars gone, and code gone. Just says ‘still being processed’. I think it just means it’s actually being processed now by a real person. Then, when approved you get a refund date. Mine is EIC so I don’t think it will come until mid-February. At least that’s what the website says.

I dont have credits no letter i got accepted on the 14th

have anyone status updated yet??? Mines still processing no bars and my topic 152 disappeared

@Taken20 If you were showing Tax Topic 152 simply means your return is still in the processing stage and topics and bars disappearing mean the process is moving along.

The general timeline of e-filed returns is: Transmission > Acceptance > Processing > Approval > Refund.

The IRS started processing returns later than in prior years and as such has a backlog to work through. They also just recently started processing returns claiming EIC and/or ACTC.

During processing, the government reviews your refund. During the review process, they look for math errors on your return (extremely rare in TurboTax) and they also check if you owe back taxes, unpaid child support, or other debts.

If they need to make any corrections, they may offset (reduce) your refund. In some cases, the correction might even increase your refund.

Once that part's done, the government approves your refund, which means it's ready to be deposited or sent. At that point the IRS site will update with a direct deposit date.

I have the same issue... bars disappeared about 5 days ago. I still had Tax topic 152 at that point with correct refund amount showing on left. Today... 5 days after bars disappeared, tax topic 152 and refund amount has disappeared. Did yours ever resolve?

Did you ever get your return I filed July 9th and mine just did the same thing ????

On my where is my refund I have Tax topic 152 but not showing any amount and still saying processing What does that mean

@Problemkid88 Here is a great article describing tax topic 152.

If you need additional assistance, please comment and let us know.

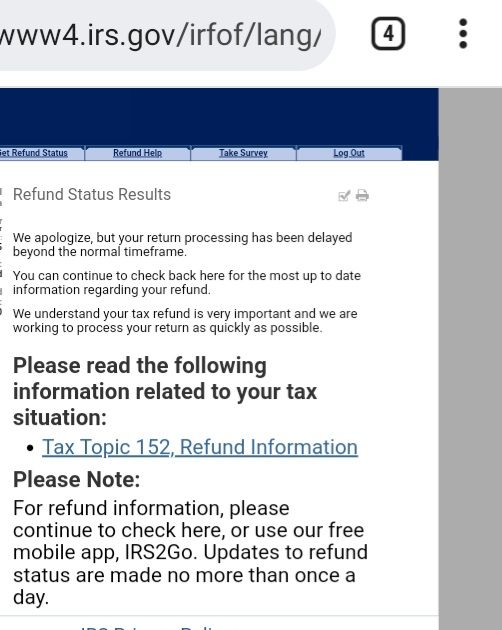

What does this mean it still topic 152 but says this can someone help me please I'm worried

If you were showing Tax Topic 152 simply means your return is still in the processing stage and topics and bars disappearing means the process is moving along.

In regards to a refund delay, please see this Help Article which explains certain instances this can happen.

I am unable to provide any further information. If anything is needed, the IRS will notify you.

Filed January 30th accepted January 30th 14 days stright irs website said they had no information of efile tax topic 152 February 14 irs website says tax refund still being processed no tax topic no bars and it is now February 21same thing still being processed can someone please help me ?

Tax Topic 152 means the IRS is still processing your return. For further details, please see this IRS Topic No.152 Refund Information article.

I have the exact same thing come up. I’m guessing it’s from the PATH Act.

Yes, exactly. Topic 152. Accepted 2/18. I had 1 bar until a couple weeks go & it switched to this. Nothing else. I’ve heard of A LOT of people having this same message. I wouldn’t worry because we’re not getting any other codes or for us to contact them. They’re just backlogged!

tax topic still showing after 21 days.. It was done on 02/02/2022 do i need to do anything

Refunds usually take about 21 days after the IRS has accepted your e-filed return. Although, sometimes it can take longer. The IRS is taking more than 21 days (and up to 90 to 120 days) to issue refunds for tax returns with the Recovery Rebate Credit, Earned Income Tax Credit and Additional Child Tax Credit. Please see What if my IRS refund is taking longer than 21 days? for more information.