egg2

Returning Member

posted Apr 2, 2022 9:06:31 PM

2021 Rejected and Amend e-file

I've e-filed my 2021 tax return through turbotax desktop software, and got rejected due to ssn typo.

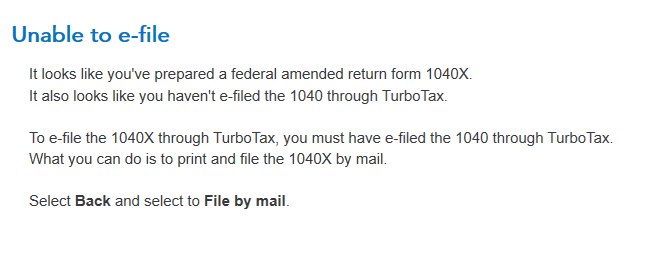

And I tried to follow the amend procedure to amend and e-file. However it tells me unable to e-file and the reason being

What does mean I haven't e-filed the 1040 through TurboTax?