How do I find and enter the cost basis for my RSU or ESPP sale?

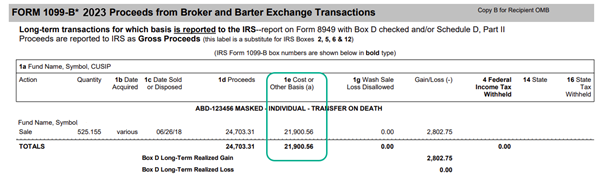

If you sold restricted stock units (RSUs) or shares from your employee stock purchase plan (ESPP), these are reported on Form 1099-B.

To report the sale of shares, you’ll enter or import your Form 1099-B into TurboTax, then manually enter the cost basis. You can find this info in the cost basis column on a supplemental form provided by your brokerage, or by following these tips.

The cost basis column on your supplemental form should look similar to the following.

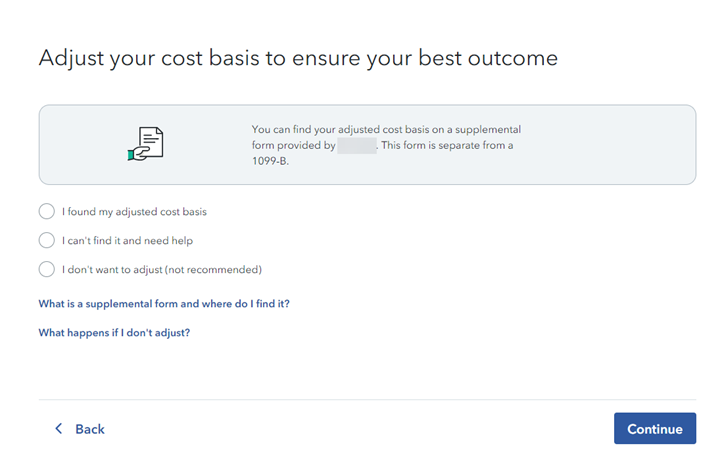

When you’re ready to enter your cost basis, select I found my adjusted cost basis on the Adjust your cost basis to ensure your best outcome screen, and follow the instructions on the screens that follow.

For RSU sales, you will be asked for your employer’s name, how many shares you sold, and other details such as total shares vested/released, shares withheld to pay taxes, and the market price on vesting date.

For ESPP sales, you will be asked for your employer’s name, how many shares you sold, and other purchase details from Form 3922.

TurboTax will adjust the cost basis according to the information you provide.

If you use Fidelity or E*Trade, you can import your RSUs and ESPPs with automated cost basis.