How do I get a copy of my tax return or transcript from the IRS?

by TurboTax•611• Updated 2 months ago

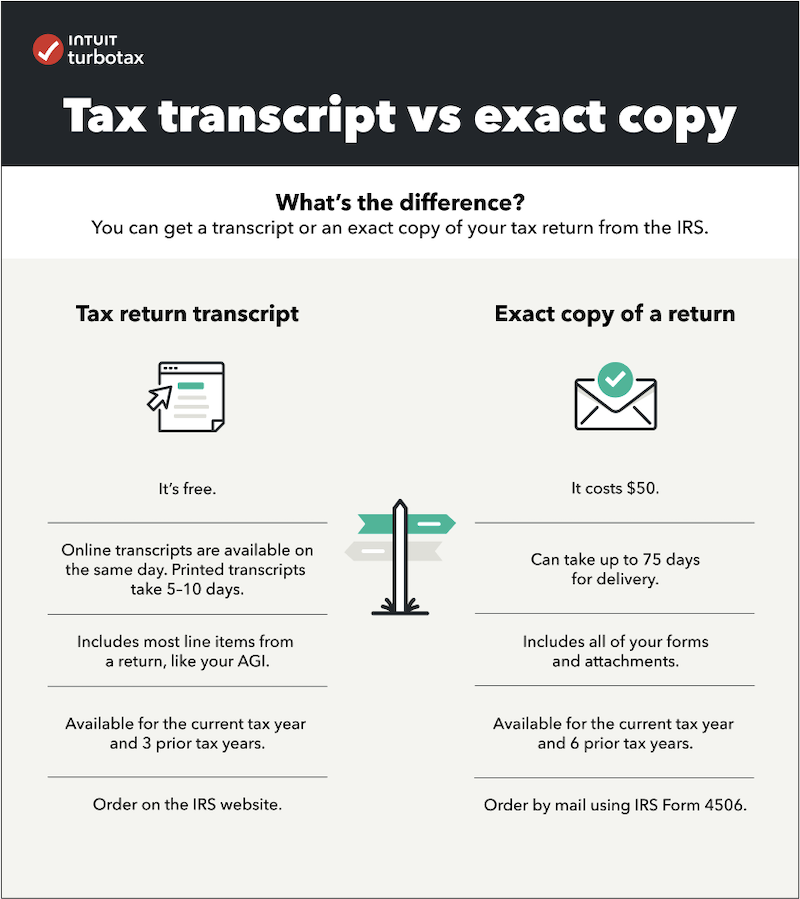

To obtain a full copy of your filed and processed tax return (including income forms such as W-2s and 1099s), print and complete IRS Form 4506, Request for Copy of Tax Return. Be sure to follow the instructions on page 2 of the printout. The IRS charges $50 for each copy. Please allow up to 75 days for delivery.

If you can't wait that long or don't want to pay the $50 fee, consider a free IRS transcript. A transcript contains most line items from your return and can be used if you need last year's AGI or other numbers from a previously-filed return. To order, go to the IRS Get Transcript page and choose an option: online (same-day) or by mail (5–10 days).

Unlock tailored help options in your account

More like this