What's the difference between a 1099-NEC and 1099-MISC for self-employed income?

Starting in tax year 2020, the IRS reinstated Form 1099-NEC to report nonemployee compensation that used to be reported on box 7 of the 1099-MISC form.

Let’s take a look at the differences.

You'll get a 1099-NEC if you:

Worked as a contractor or freelancer

Were paid for your self-employed goods or services

Previously received these payments on a 1099-MISC

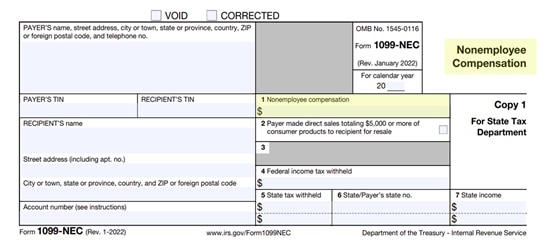

Take a look at the 1099-NEC:

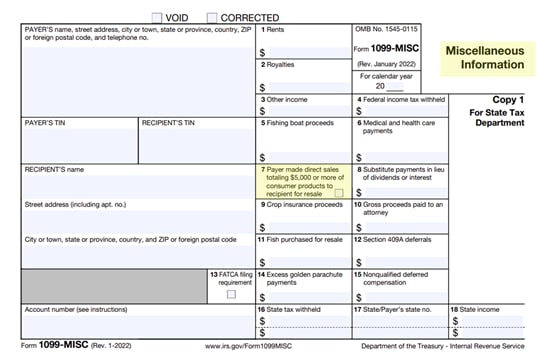

Compare it with the 1099-MISC:

Box 7 no longer reports nonemployment compensation now that the 1099-NEC form is being used. The 1099-MISC is mostly used for miscellaneous income like rent or royalties.

If you were paid for your work on a 1099-MISC, contact the payer directly and ask them to send you a 1099-NEC form instead.

Rest assured that TurboTax will guide you through entering all of your self-employment income and help you enter any expenses to reduce your taxable income.