- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self employed

Royalties can be entered directly without entering your 1099-MISC. First delete this form using the instructions below for TurboTax Desktop.

You'll need to delete Form 1099-MISC.

- If you're using TurboTax Desktop software and need to delete a form, click here.

Follow the instructions below to enter your royalty income.

- Next Open your TurboTax Desktop return.

- Search (upper right) > type royalties > Click the Jump to.. link

- Select Yes - Income from Rentals or Royalty Property You Own > Continue on the next screen

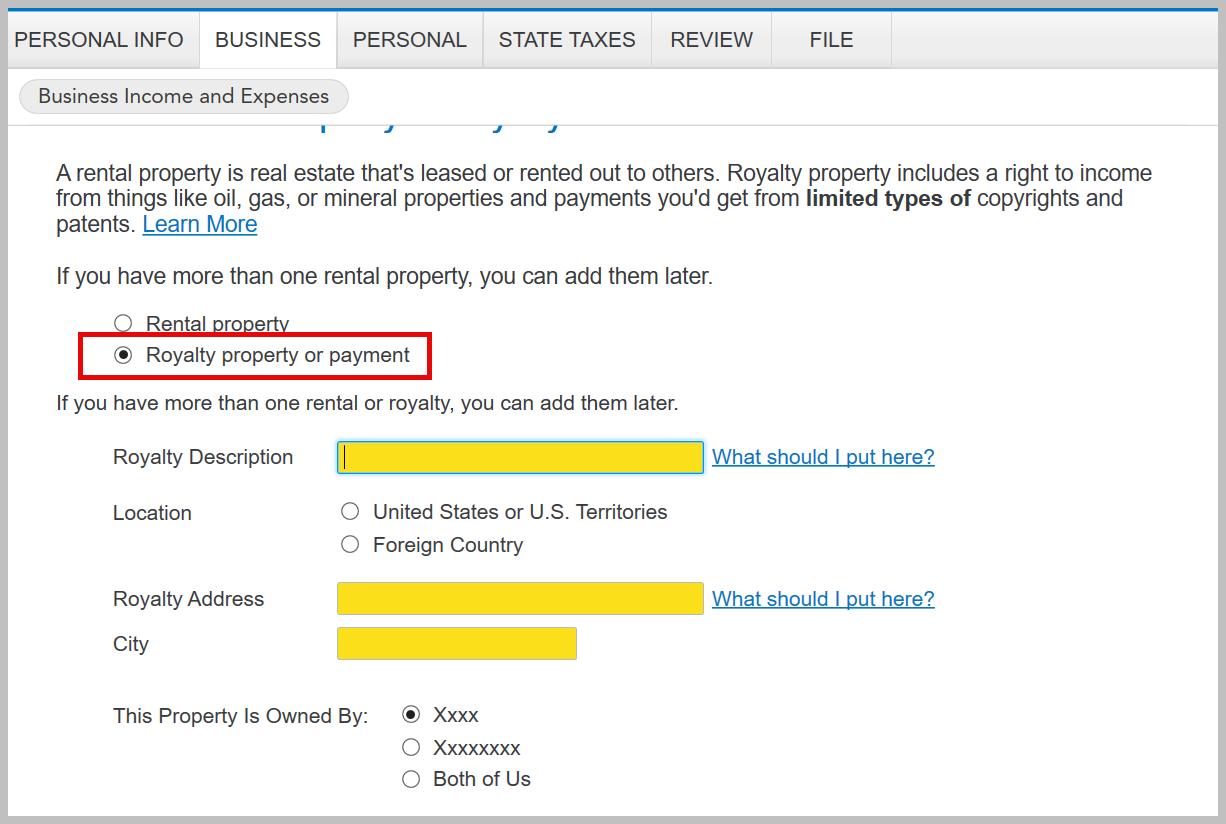

- Start or Add another Rental or Royalty > Select 'Royalty Property or payment' > Enter the Royalty Description, Address and City

- Continue to answer the questions until you complete your royalty property

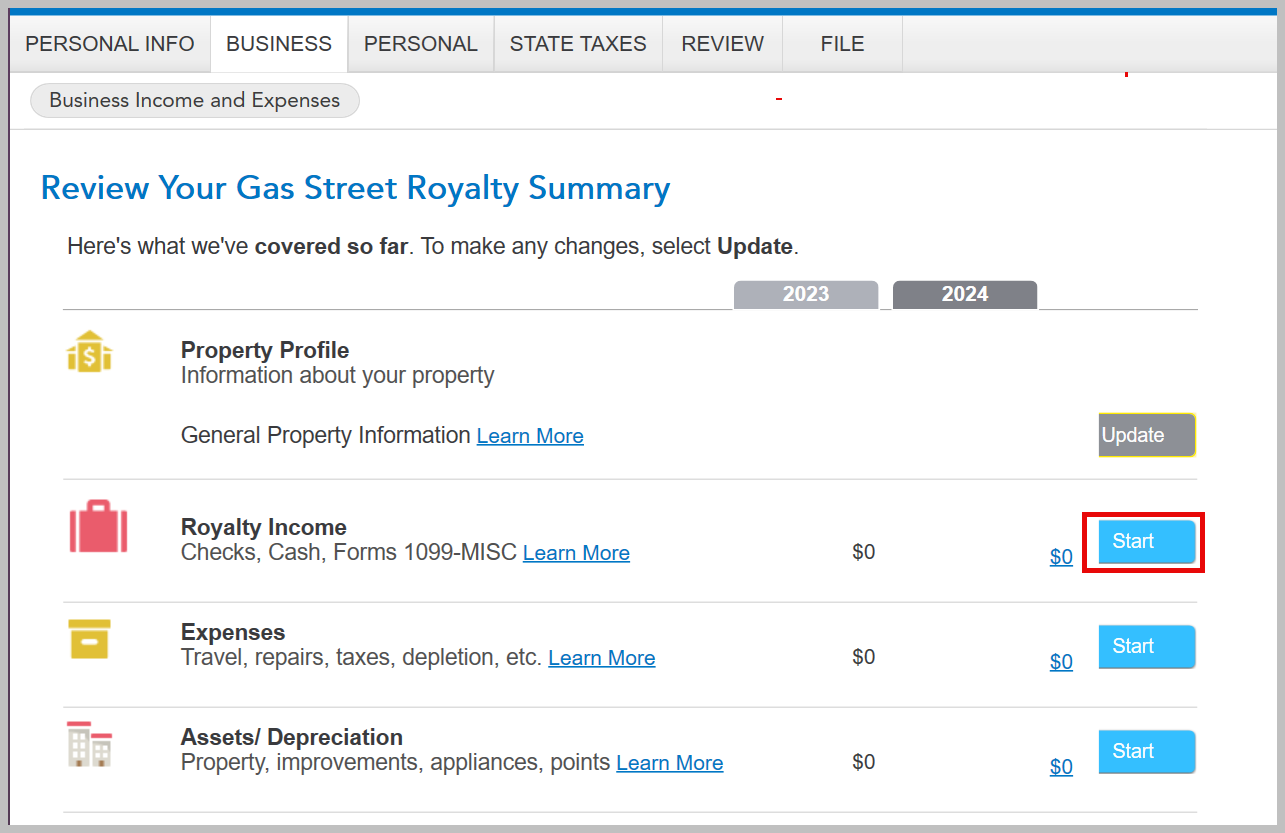

- When you come back to the screen 'Review Your___ Royalty Summary' select Royalty Income

- Select any expenses and complete your entry for Royalty Property

Depending on the type of royalties you may have depletion expenses.

[Edited: 02/12/2025 | 3:41 PM PST]

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 12, 2025

3:39 PM