- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

Please ensure that you indicated that you are active-duty military since that should trigger the state return to apply deduction. There are two places where you might indicate that you are military active duty:

- The first is in the "My Info" section after you enter your name and occupation. You can click on "My Info" on the left and then click on "Edit" next to your name.

- The second is on the "Do any of these uncommon situations apply to this W-2?" screen, right after you enter your W-2, you can check the active-duty military box for the W-2.

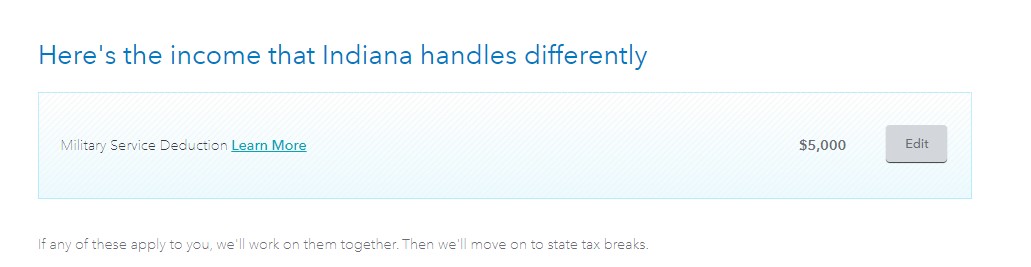

During the State interview, you should see the $5,000 military service deduction on the "Here's the income that Indiana handles differently" screen. Click on "Start" to answer questions then you should be able to qualify for the deduction.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 3, 2020

12:20 PM