- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable IRA Distributions

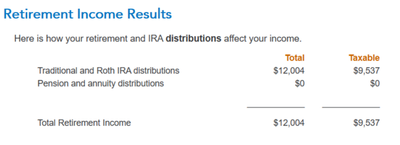

In 2019, my wife and I each contributed non-deductible $6k to an IRA. We then converted all of this to a Roth IRA. We received a 1099-R showing a total of $12,004. Entering this into TurboTax, it gave us a message that we don't owe extra taxes on this money. When I finish the deduction section, I get the following message:

Where is the taxable $9,537 coming from?

February 8, 2020

11:15 PM