- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

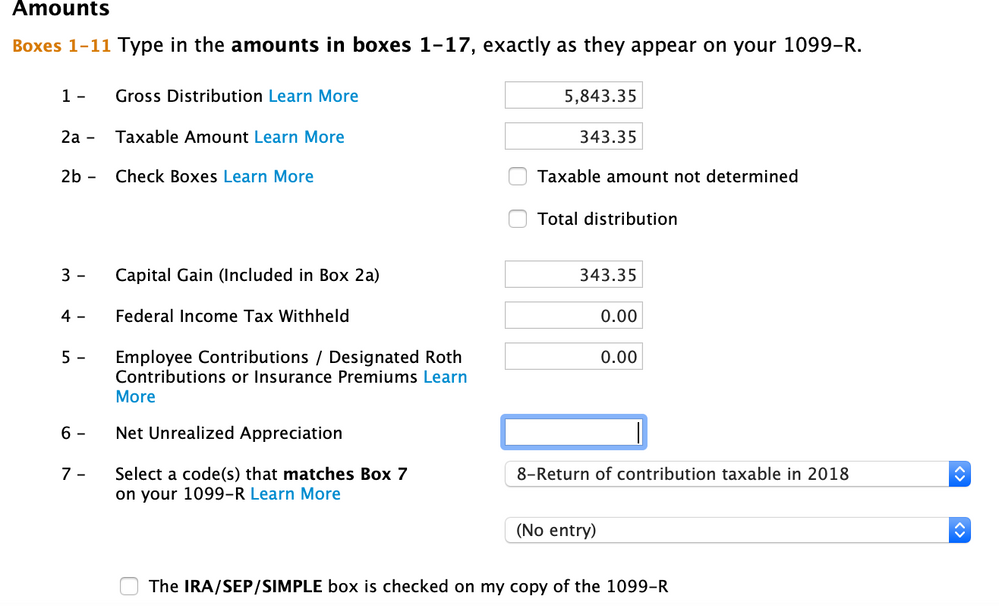

Completing 1099-R on my taxes without a 1099-R form. Am I doing this correctly?

I didn't receive a 1099-R for 2018, but need to report gains because I over-contributed in 2018.

I contributed $5,500 and my gains were $343.35. I already did an excess removal of $5,500 plus the $343.35 gains before the deadline.

Can anyone advise if I'm filling in this information correctly? When I look back at my income overview in Turbo Tax, it looks like I'm being taxed on $5,843.35 vs the $343.35 gains.

October 12, 2019

3:21 PM