- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

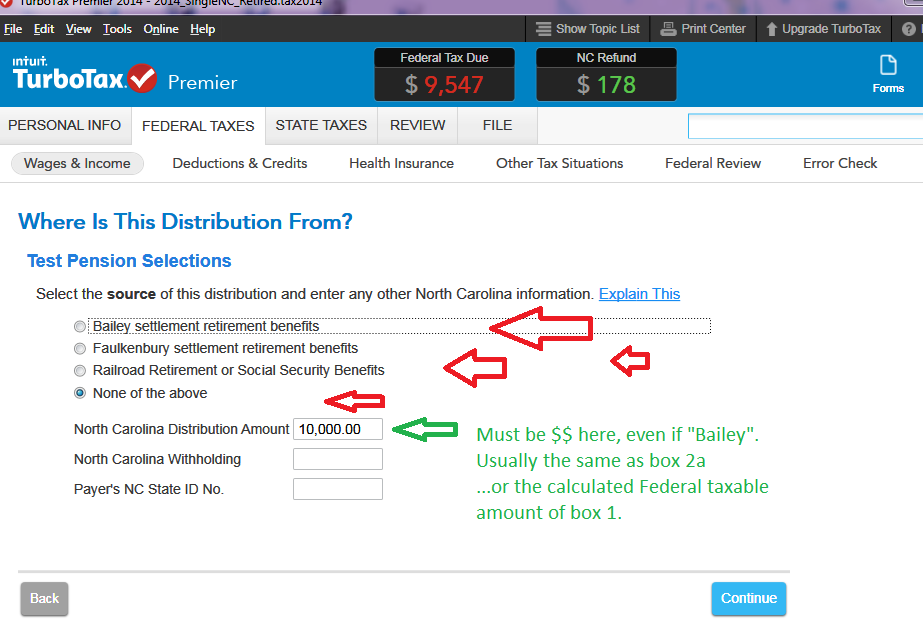

I am answering questions for my NC Retirement income. I qualify for the Bailey state deduction. It is asking what the NC distribution is. Do I list my total income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

1) For the NC Distribution Amount, you would enter the value of box 2a of that particular 1099-R form.

2) IF box 2a is empty or 'unkown", then it would be the Federally-taxable portion of box 1, once that value has been calculated.

NC starts with the Federal AGI as the starting point for it's tax returns.....that Federal AGI includes the box 2a value (or the federally taxable amount of box 1 in that starting AGI). Once you click on the "Bailey Settlement" button on the followup page (after you enter the main 1099-R, or CSA-1099-R form in the Federal section of the software)...once you click on that Bailey Settlement button, it uses the "North Carolina Distribution Amount" that you entered and that becomes the $$ value that will be deducted from the Federal AGI to create a new NC-AGI....so that value is critical to be entered.

________________________________________