- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

if you missed an RMD, TurboTax will help you with filing the waiver. As you report your 1099R there'll be a series of questions asking about RMD's.

- First question asks what the RMD requirement was for 12/31/2024. You would list the amount that you were required to withdraw.

- Next question you will say none of the distribution was applied to the RMD.

- Next question asks if you took out the remaining distribution, say no.

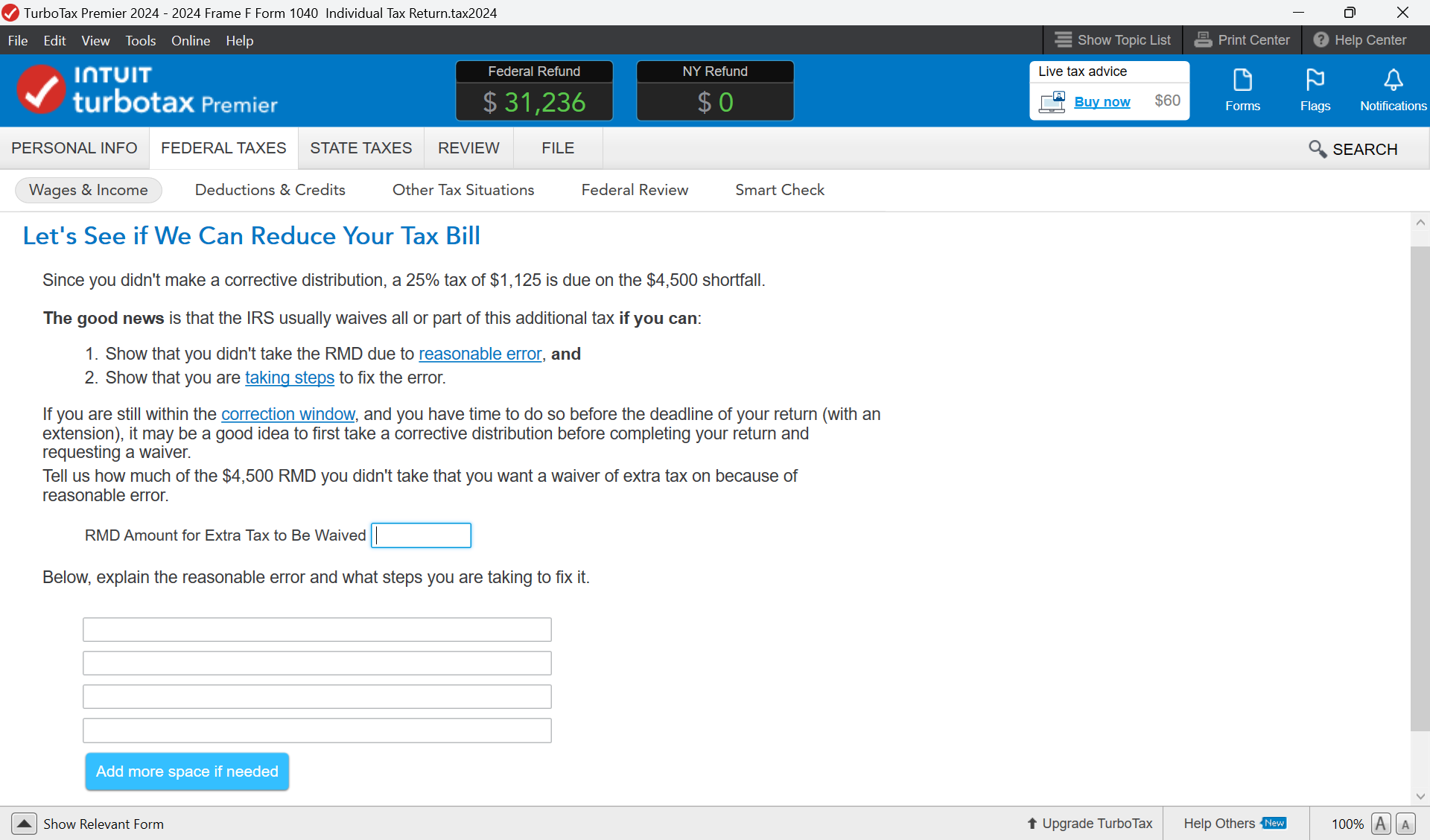

- Now just continue through the screens. until you get to a screen that mentions requesting the waiver.

- Next screen will allow you to enter information that may reduce the penalty. This is what the screen looks like.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 15, 2025

7:27 AM