- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

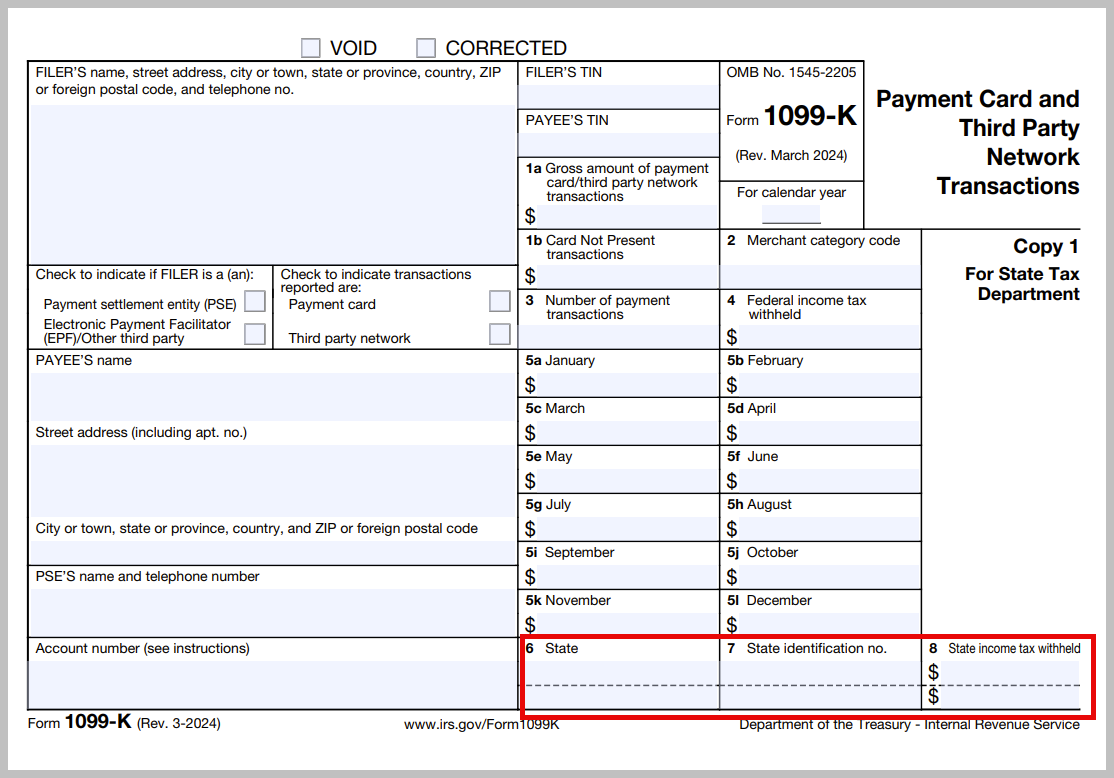

The only time you need a state identification number is if you had state tax withheld from your form on box 8. If you don't have anything on box 8 then leave boxes 6 and 7 empty. If you did have an amount on box 8 for state withheld then you will need to get a state id from the company that issued the 1099-K.

April 6, 2025

2:23 PM