- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

You should have received a 1099-R from your 401(k) plan administrator. Report this in TurboTax by navigating to Federal > Wages & Income >IRA, 401(k), Pension Plan Withdrawals (1099-R).

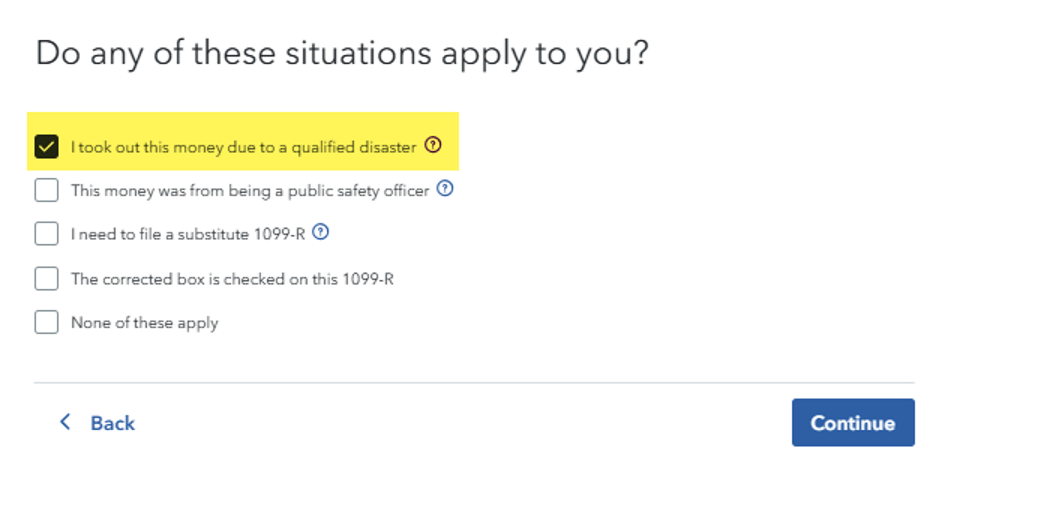

In order to ensure you pay the tax over a three-year period instead of one, and are exempt from the usual 10% penalty on early distributions, check the box I took out this money due to a qualified disaster after entering your 1099-R.

April 5, 2025

6:06 AM