- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

It can be allowed as a deduction.

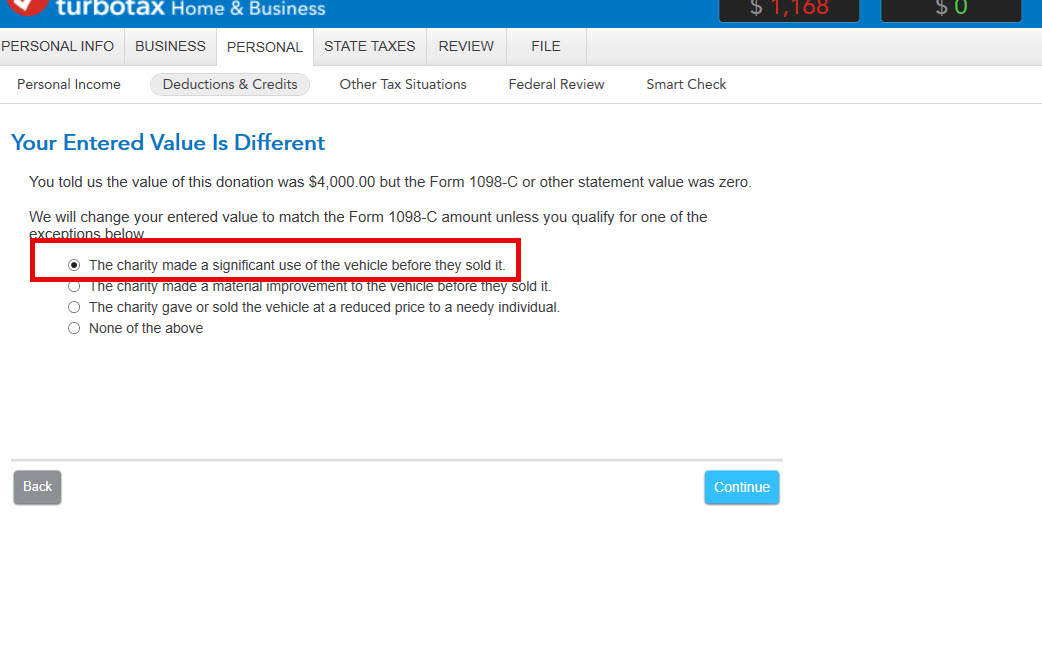

After you entered the 1098-C, continue with the interview

Be sure to elect

"The charity made significant use of the vehicle before they sold it." (even if they did not yet sell it)

The full value of the donation should then be allowed.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 17, 2025

3:27 PM

1,814 Views