- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

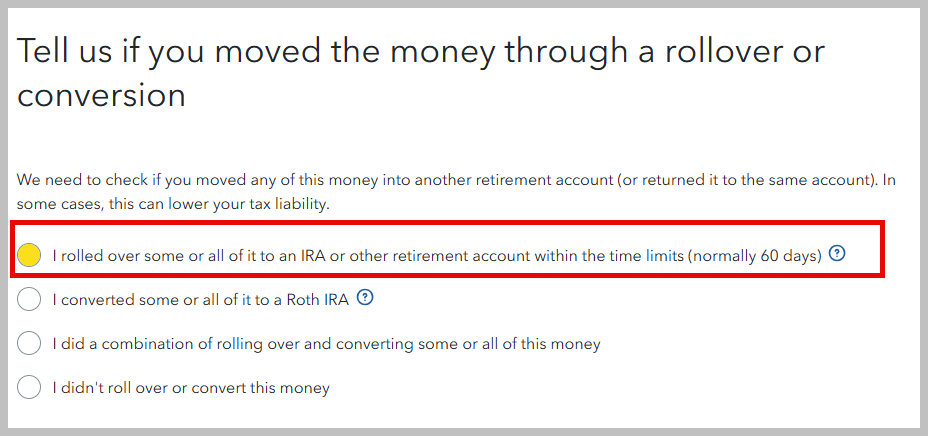

When you enter the 1099-R, you will be asked what you did with the money. When you reach the screen 'Tell us if you moved the money through a rollover or conversion'

- Select 'I rolled over some or all of it to an IRA or other retirement account within the time limits (normally 60 days)'

- Once this is completed for your IRA, the portion you rolled over will be tax free.

However for any amount you did not roll over you will pay tax and penalty if you are below 59 1/2 years of age.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 15, 2025

2:30 PM